Local tax withholding rates - accurate with Symmetry Payroll Point®

Automate your local payroll that combines location data with the Symmetry Tax Engine® to deliver precise tax withholding rates based on latitude and longitude coordinates. With access to thousands of geospatial tax boundary shapefiles, Symmetry Payroll Point® boosts tax and wage rate accuracy at every level — federal, state, and local.

Accurate local taxes and wage rates

Symmetry Payroll Point® calculates precise wages and tax rates for the most complex tax withholding scenarios, based on latitude and longitude coordinates. The responses combine tax data from the Symmetry Tax Engine® with proprietary mapping technology and geospatial boundary maps to return the most accurate and up-to-date tax rates from our local tax API.

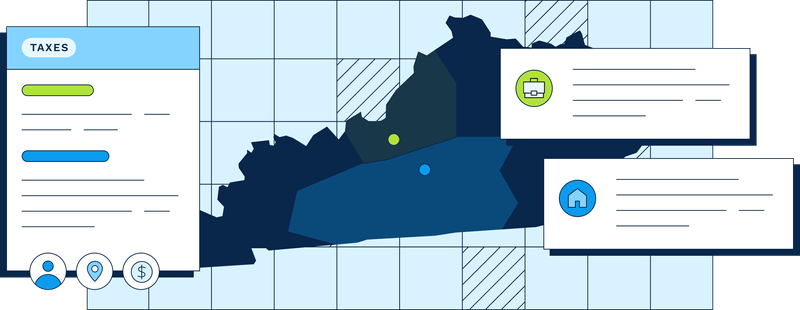

1Address

Enter the local home address and the work address into Symmetry Payroll Point. You can also search by latitude and longitude coordinates.2Geocoding

Symmetry Payroll Point validates both addresses using true geocoding technology and determines latitude and longitude coordinates of the locations.3Shapefiles

Symmetry Payroll Point uses coordinates with 35,000 geospatial tax boundary shapefiles from the U.S. Census Bureau, state tax jurisdictions, and Symmetry’s proprietary data.4Local Tax Rates

Symmetry Payroll Point calls the Symmetry Tax Engine to retrieve values and return all applicable federal, state, local, and employer taxes and rates.

Advanced mapping technology

Leverages innovative geocoding technology to convert street addresses into geographic coordinates for precise rooftop accuracy on tax boundary shapefiles. Shapefiles include states, counties, cities, zip codes, jurisdictions, school district boundaries, and more.

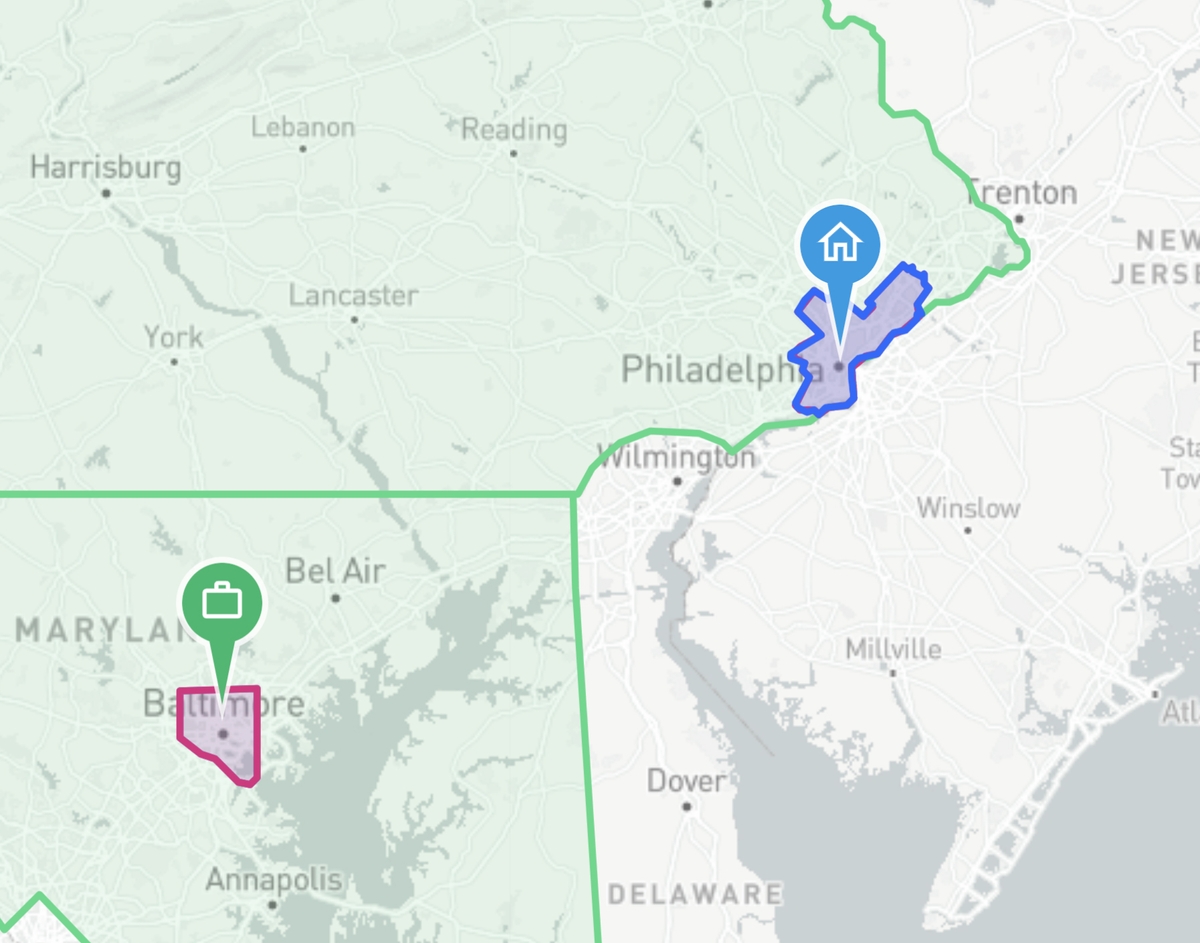

Accurate multi-state localized taxes

Considers nexus and reciprocity with every input, so employees who live in one state and work in another will be onboarded correctly and taxed appropriately. Also provides local tax information such as Ohio JEDDs and JEDZs and Pennsylvania Act 32 PSD codes.

Increase your tax compliance

Increases payroll tax compliance while reducing notices, inquiries, incorrect taxation, W‑2cs, and inaccurate wages. Local maps locations and displays accurate values for addresses.

Who will love it?

"Payroll Point has helped Sodexo accurately withhold local taxes for their employees, and has reduced tax jurisdiction notices, employee tax corrections, and W‑2Cs."

"Payroll Point batch is saving us 10 hours a week."

Integrates seamlessly

Symmetry Payroll Point uses the latest technology to allow you to embed payroll directly into your platform to accurately determine complex federal, state, and local taxes based on work and residential addresses.

Symmetry Payroll Point provides flexibility for implementation, including two versions to fit your business needs. With the API and Portal, you get the same accurate local tax determination results. What varies is how you access the technology and how many transactions you perform at one time. Also available in a Minimum Wage Finder.

Tax API integration

Embeds directly within your payroll platform to pull employee information and automate tax withholding settings to complete payroll and keep you compliant. Ideal for implementation into payroll systems and for large employers looking for a simplified and automated integration of local tax determination.

The API is a technically driven experience. Payroll departments would have to work in tandem with developers to enable this solution.

"taxResults": [

{

"uniqueTaxID": "34-000-0000-ER_SDI-001",

"description": "New Jersey Employer SDI",

"rate": 0.005,

"rateType": "RATE_PERCENT",

"wageBase": 42300.0,

"taxLimit": 211.5,

"taxLimitPeriod": "Annually",

"taxStartDate": "2024-01-01",

"credit": 0.0,

"creditLimit": 0.0,

"paid": false,

"stateWide": false,

"stateName": "New Jersey",

"employerTax": true,

"resident": true

},

...

]Local Tax Portal

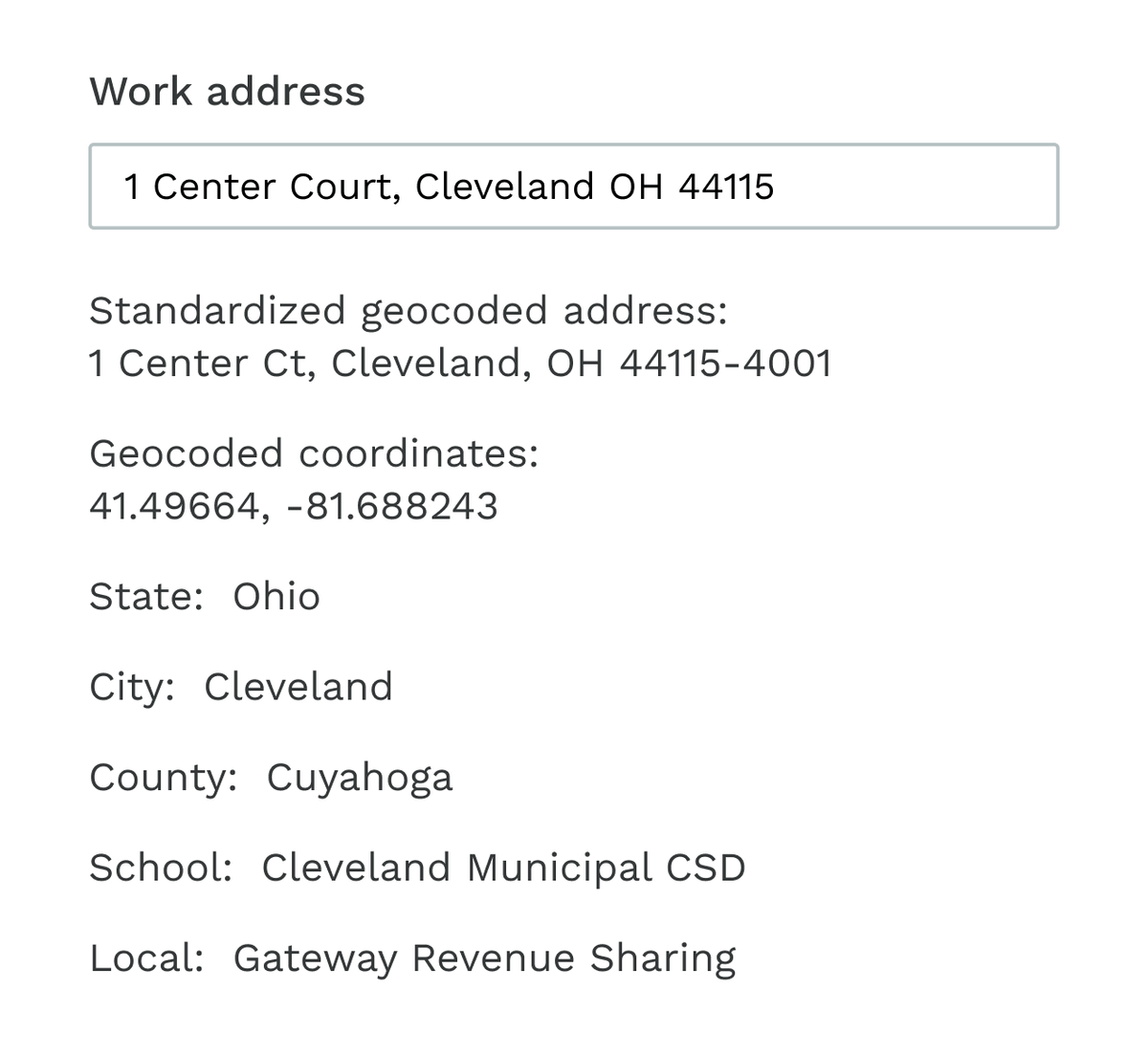

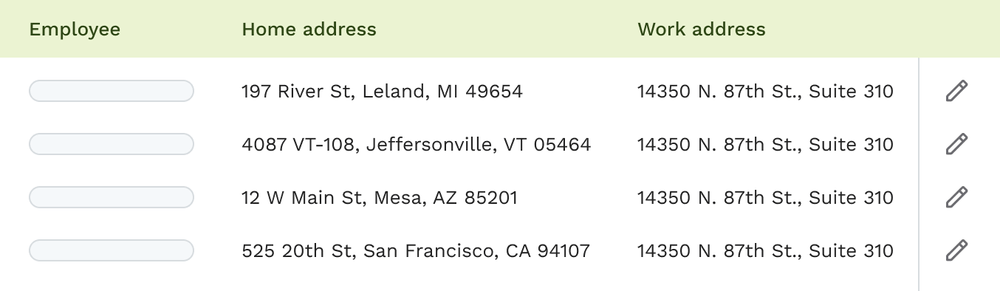

A modern and powerful user interface to return precise taxes using the Symmetry Payroll Point maps and batch technology. Troubleshoot addresses to focus on challenging home and work address combinations. Gather detailed tax withholding for thousands of employees by processing a group of addresses at once.

Portal maps

The maps interface identifies tax jurisdictions with geospatial visualizations, making it quicker to research complex taxing scenarios.

Portal batch

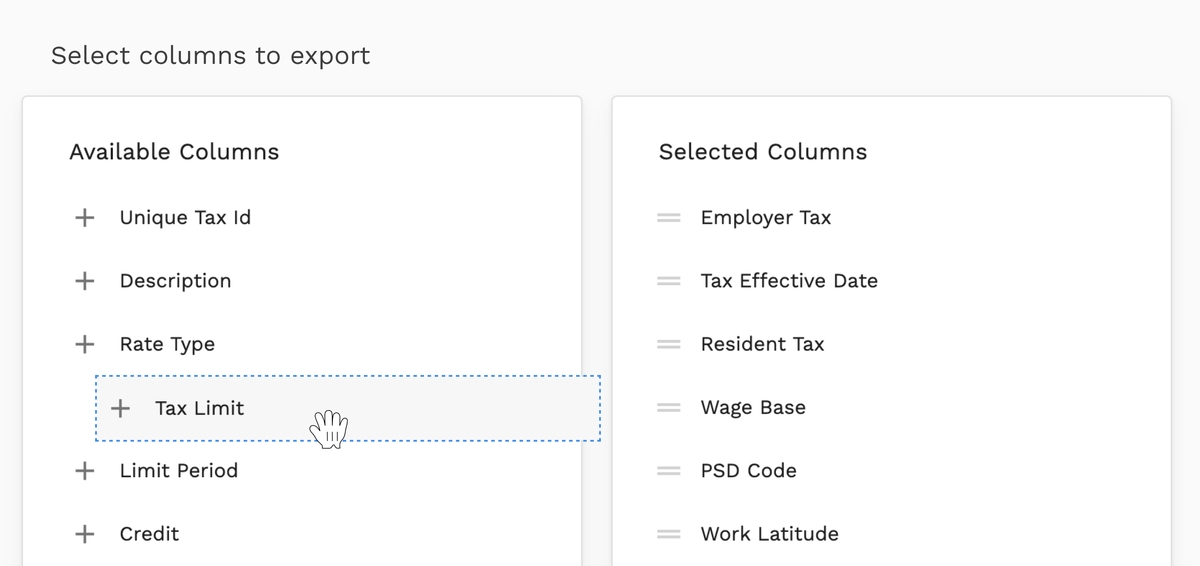

The batch processing is streamlined for easier upload, review, and export of tax results.

Portal reports

Customize templates to download results to your specifications. Select from over 80 fields from geocoding results, tax information, and location information. Payroll tax information such as taxing authority, rate, effective date, and wage type are also included.

Why geocoding is so important when it comes to local tax determination

Geocoding provides geographical coordinates corresponding to a location, in Symmetry Payroll Point’s case, the employees’ home and work addresses. We then apply these latitude and longitude coordinates to tax boundary shapefiles in order to precisely return the taxes that apply to each employee.

In some cases, a coordinate that is just a few meters off could result in a completely different tax setup! That is why our ability to pinpoint the rooftop location of employees’ home and work addresses translates to the most accurate tax determination.

FAQ

Contact us if you don't find your question answered here about Symmetry Payroll Point.

- Validates work and home addresses provided by the client.

- Determines the exact longitude and latitude coordinates for the locations.

- Applies coordinates to 35,000 geospatial tax boundary shapefiles.

- Calls the Symmetry Tax Engine to retrieve values and returns all applicable federal, state, local, and employer taxes and rates.

Get started

Looking for more?

Symmetry Minimum Wage Finder

Automated and accurate federal, state, and local minimum wage rates into your application by using exact location coordinates.

Symmetry I-9

Fast, compliant I-9 verification software for onboarding and payroll providers. Offers all Section 2 verification methods (including remote) and full E-Verify integration.

Symmetry Payroll Forms

Directly integrates and automates the withholding forms process at the federal, state, and local levels with over 130 compliant forms.