Payroll tax compliance guides and resources

An in-depth look at some of payroll’s most challenging topics

![Future-Proof Your People Tech Platform For 2026]() GuideFuture-Proof Your People Tech Platform For 2026

GuideFuture-Proof Your People Tech Platform For 2026Don’t let relentless tax complexity block your roadmap. Learn the strategic roadmap to achieve day-one accuracy, master over 7,000 local tax jurisdictions, and turn payroll tax compliance into a product differentiator.

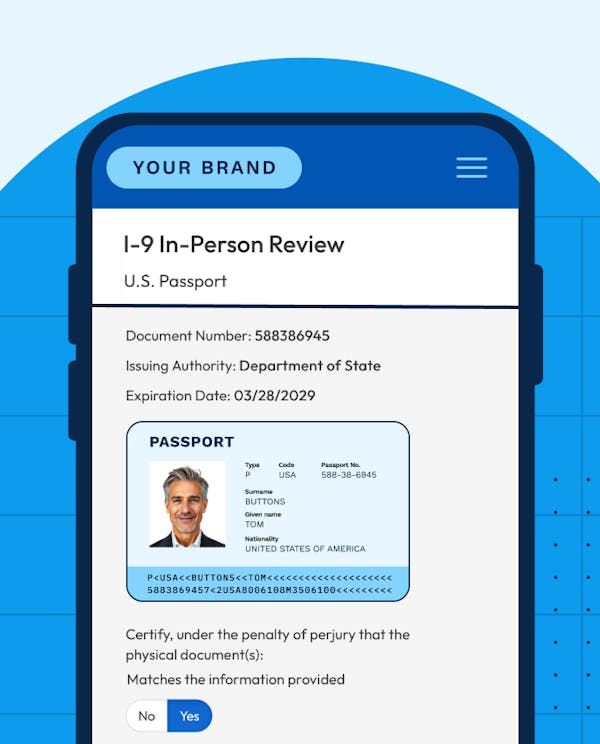

![Automating Form I-9 Verification: A Guide for HR Tech, Payroll, and Onboarding Providers]() GuideAutomating Form I-9 Verification: A Guide for HR Tech, Payroll, and Onboarding Providers

GuideAutomating Form I-9 Verification: A Guide for HR Tech, Payroll, and Onboarding ProvidersSurvey of 300 HR professionals reveals I-9 pain points—and why HR Tech payroll, and onboarding platforms must deliver automation now.

![Build, Buy, or Blend? Finding the Right Payroll Tax Infrastructure for Growth]() GuideBuild, Buy, or Blend? Finding the Right Payroll Tax Infrastructure for Growth

GuideBuild, Buy, or Blend? Finding the Right Payroll Tax Infrastructure for GrowthCompare build, buy, or blend payroll tax APIs. See how Symmetry speeds compliant, scalable payroll launches.

![Solving Tax Compliance Challenges For Payroll Products]() GuideSolving Tax Compliance Challenges For Payroll Products

GuideSolving Tax Compliance Challenges For Payroll ProductsSymmetry helps people tech platforms tackle the competitive payroll market by ensuring compliance and providing accurate and efficient tax calculations.

![Choosing the Right Tax Compliance API for your Payroll Product]() GuideChoosing the Right Tax Compliance API for your Payroll Product

GuideChoosing the Right Tax Compliance API for your Payroll ProductLearn about the key selection criteria to embed payroll tax compliance and gross-to-net calculations into your product or technology platform.

![The Buyer’s Guide

to Payroll Tax Engines]() GuideThe Buyer’s Guide to Payroll Tax Engines

GuideThe Buyer’s Guide to Payroll Tax EnginesLearn how to design payroll software that meets complex payroll tax compliance requirements across federal, state, and local jurisdictions. See how top providers use Symmetry Tax Engine to automate calculations, filings, and updates at scale.

![Fringe Benefits]() GuideFringe Benefits

GuideFringe BenefitsUnderstand taxable vs. non-taxable fringe benefits with confidence. This IRS-aligned guide explains de minimis benefits, service and safety awards, and accurate W-2 reporting for compliant payroll operations.

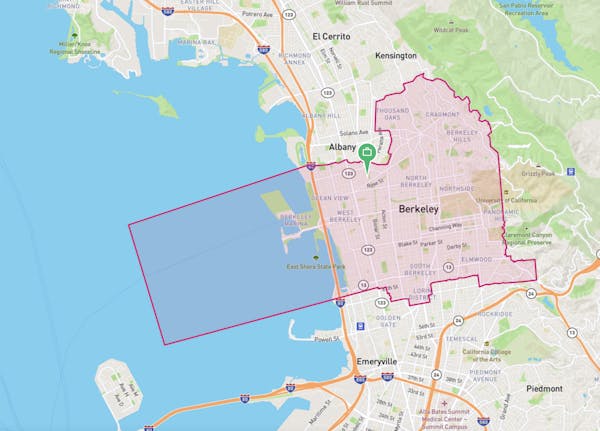

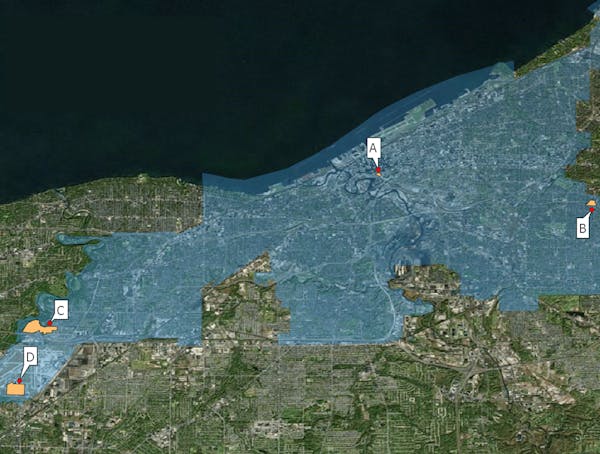

![Payroll Tax Geocoding Guide]() GuidePayroll Tax Geocoding Guide

GuidePayroll Tax Geocoding GuideZip codes aren’t enough for payroll tax accuracy. Discover how geocoding ensures precise tax withholding and compliance across federal, state and 7,400+ local tax jurisdictions—powered by Symmetry’s geospatial payroll tax automation.

![Local Taxes]() GuideLocal Taxes

GuideLocal TaxesNavigate the complexity of local payroll tax compliance. Discover how to automate accurate local tax withholding across 7,400+ jurisdictions—including Ohio JEDDs and Pennsylvania Act 32—using address-level geocoding and location-based precision.

![Multi-State Payroll]() GuideMulti-State Payroll

GuideMulti-State PayrollRunning payroll across state lines? Discover how to manage nexus, reciprocity, and nonresident certificates with precision. This guide explains how Symmetry’s Tax Engine automates complex multi-state payroll tax calculations for modern HR tech and payroll platforms.

Client stories

Hear from our best clients

Wave

Leading small business payroll provider relies on Symmetry products to expand into the U.S.

Salsa

Embedded payroll provider Salsa gains “huge strategic difference” building with Symmetry Tax Engine.

Findd

Cutting-edge time & attendance platform expands offerings with addition of Symmetry Payroll Forms.

Industry-leading Recruiting Software

Industry-leading recruiting software expands its offering with Symmetry’s payroll tax forms.