The leading gross-to-net calculation payroll software

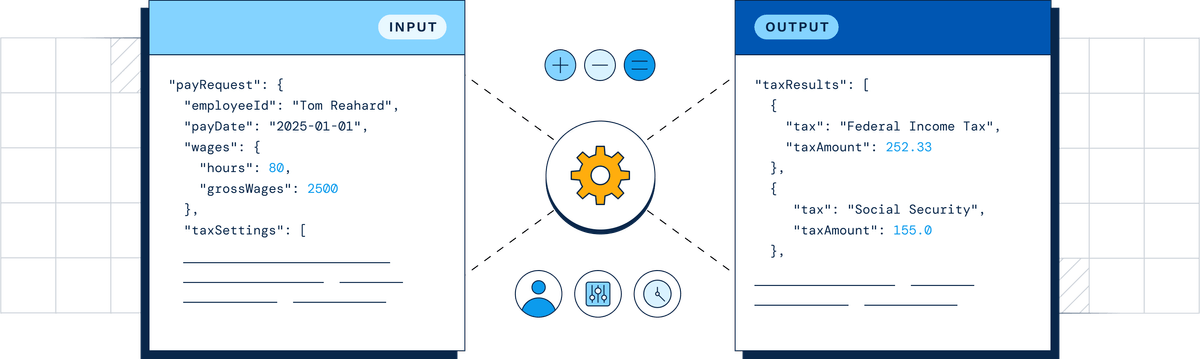

The Symmetry Tax Engine® (STE) is a powerful gross-to-net calculation engine to build or enhance a payroll platform, embed payroll into an existing application, and increase payroll tax compliance and accuracy. Available for both U.S. Canada.

If there’s a tax, we calculate it

The Symmetry Tax Engine® accounts for federal, state, and local payroll taxes — both withholding and latent employer taxes — for over 7,400 taxing jurisdictions and U.S. territories. Employer taxes and multi-state processing are accounted for as well.

Symmetry Tax Engine® covers payroll tax compliance in all 50 states, U.S. territories including Puerto Rico, and Canada.

- Federal withholding

- FICA (Social Security & Medicare)

- Paid family & medical leave

- SDI/VDI/Employee SUI

- Courtesy withholding

- FUTA & SUTA

- Benefits and pre-tax benefit rules, down to the local tax

- Various other employer taxes

- City

- County

- School district

- Municipality

- Earned income taxes

- Privilege taxes

- Local services taxes

- JEDDs/JEDZ

The most powerful payroll tax engine on the market

- 40% of the U.S. workforcehas paychecks powered by Symmetry

With over 1 billion paychecks calculated to date, we’ve handled almost every complex taxation scenario. No other solution has the same time-honed record of reliability and accuracy.

- 132 million+home and work address pairs processed each year

Covers multi-state calculations with reciprocity and nexus while using cutting-edge geocoding technology to determine accurate payroll taxes.

- 3.32 millisecondsaverage time per payroll tax calculation

When running hundreds or thousands of paychecks, every millisecond counts. The tax engine returns 150,000 gross-to-net calculations in just 7.5 minutes for the On-Prem solution.

- 99.99% uptimewith industry-leading security measures

The Symmetry Tax Engine® doesn’t store any personal data. API communications are encrypted in transit. Learn about uptime and security practices.

Who will love it?

For large employers, payroll, or HCM software providers, payroll taxes are an incredibly complicated, ever-changing burden to keep up with. Companies can effortlessly ensure employee and employer taxes are accurately calculated by Symmetry’s payroll tax APIs and software tools.

Who you are

- Entrepreneur

- Software Developer

- Payroll or HR Service Provider

- Large Employer

- Payroll Manager

- Payment Company

What you do

- Building a payroll system from scratch

- Processing payroll in-house

- Adding payroll to your existing offering

- Expanding to new geographic markets

- Building a next-generation payroll system

- Supplementing calculations that don’t deliver all applicable payroll taxes

"I’ve been in this business a long time, and even though Symmetry provides services for companies that are a lot larger than we are, it feels like you’re still dealing with a family, with that kind of culture. I feel they genuinely care and will do everything they can to accommodate you."

Product Management at a leading information technology company"The biggest challenge we faced as an organization was how do we build and maintain a payroll calc engine that supported federal, state, and local calculations at a price point that was both effective and efficient for our business."

The nuts and bolts

The Symmetry Tax Engine® was built by developers for developers, with more payroll integration flexibility for implementation and additional features, including options for a web API or on-premise SDK. With either version, you get the same great engine. The difference is where it’s installed and who does the testing and updating.

Web APIrecommended

On-Premise Software Development Kit (SDK)

Symmetry Location Service for Local Taxes

The STE uses the Symmetry Location Service to calculate taxes based on an employee’s home and work address. Location codes never change and are based on the Geographic Names Information System (GNIS), the federal standard for geographic nomenclature.

"LocationCodeRequest": {

"locationName": "Symmetry",

"address": {

"streetAddress1": "14350 N 87th St",

"streetAddress2": "Ste 310",

"city": "Scottsdale",

"state": "AZ",

"zipCode": "85260"

}

}Payroll tax tools for every stack

The STE contains nine different interfaces to suit your development preferences. These interfaces allow the STE to integrate with your development language.

| Language | Web API | On-Premise SDK | |||

|---|---|---|---|---|---|

| Language | Web API | Windows 32‑bit | Windows 64‑bit | Linux 64‑bit* | macOS** |

| JSON | Yes | Yes | Yes | Yes | Yes |

| XML | Yes | Yes | Yes | Yes | Yes |

| C/C++ | No | Yes | Yes | Yes | Yes |

| Java | No | Yes | Yes | Yes | Yes |

| .NET | No | Yes | Yes | No | No |

| .NET Core | No | No | Yes | Yes | Yes |

| Delphi | No | Yes | No | No | No |

*The STE supports both AMD64 (x86_64) and ARM64 architectures for Linux.

**The STE universal macOS binary supports both the AMD64 (x86_64) and ARM64 (M1/M2) architectures.

Payroll Tax Notification Service

Track payroll tax rate changes

All STE clients also receive the Symmetry Tax Notification Service, which includes real‑time updates when a payroll tax changes, supporting documentation from primary sources, tax‑effective dates, and the version of the STE in which the new or updated tax is available.

FAQ

Contact us if you don't find your question answered here about Symmetry Tax Engine®.

Get started

Looking for more?

Canadian Payroll Tax Engine

Calculate gross-to-net payroll taxes to build or enhance a payroll product, embed payroll into an existing application, and increase compliance.

Symmetry Payroll Point

Determines complicated local withholding tax rates within your product by applying latitude and longitude coordinates of a residential address and a work address against Symmetry’s expansive library tax shapefiles, nexus and reciprocity algorithm.

Symmetry Payroll Forms

Directly integrates and automates the withholding forms process at the federal, state, and local levels with over 130 compliant forms.