Geocoding example

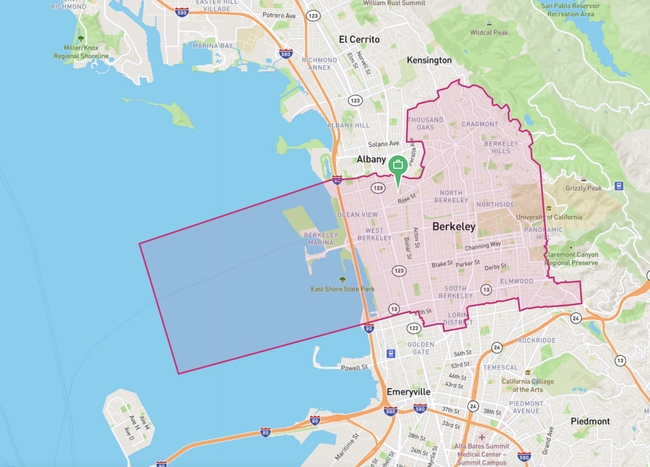

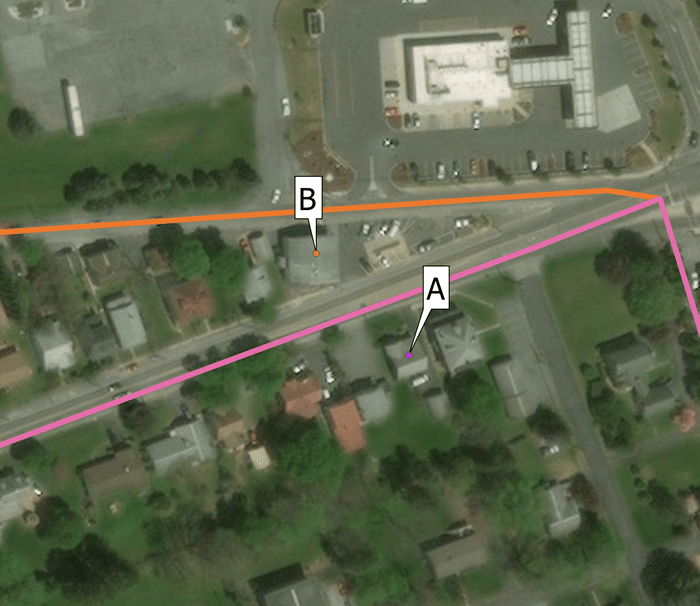

To illustrate why geocoding is so important in the payroll tax determination process, it’s helpful to have a live example. Here are two addresses across the street from one another and which differ by only one digit in the street number.

Here are two addresses, just across the street from one another:

- A

807 W Trindle Rd

Mechanicsburg, PA 17055 - B

808 W Trindle Rd

Mechanicsburg, PA 17055

The first address when run through Symmetry Payroll Point yields the following geocoded location results, for 2022:

- Geocoded location

County: Cumberland

Municipality: Township of Monroe

School district: Cumberland Valley SD

PSD Code: 210403 (rate: 1.6%) - Employee tax

Pennsylvania State Tax: 3.07%

Pennsylvania SUI: 0.06%

Township of Monroe — Cumberland Valley School District EIT: 1.6%

Township of Monroe — Cumberland Valley School District LST: $52.00

The second address when run through Symmetry Payroll Point yields different geolocation results despite its close proximity to the first address.

- Geocoded location

County: Cumberland

Municipality: Township of Silver Spring

School district: Cumberland Valley SD

PSD Code: 210404 (rate: 1.7%) - Employee tax

Pennsylvania State Tax: 3.07%

Pennsylvania SUI: 0.06%

Township of Silver Spring—Cumberland Valley School District EIT: 1.7%

Township of Silver Spring—Cumberland Valley School District LST: $52.00

In the second example, the address is in a different township and has a different PSD code and rate. You can see that the EIT rate, which comes from the school district and municipality, is different for each address. The geocoding process along with applying Symmetry’s geospatial boundary shape files, allows us to determine what school district the address is in, what taxes apply to that address, and what the PSD code is. These pieces of information, along with the municipality and county, are critical for accurately completing the Pennsylvania Residency Certification Form and withholding proper taxes.

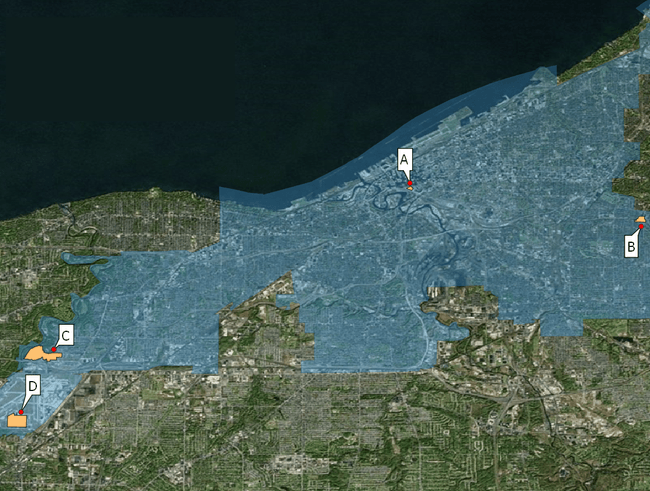

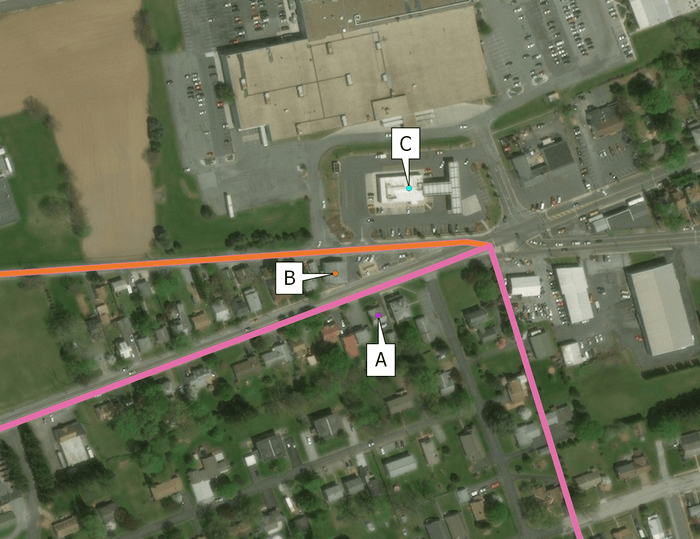

Why is Geocoding a better option for tax determination than zip codes?

Simply speaking, zip codes alone are too broad to get proper tax determination. As the example above showed, two addresses in the same zip code can have very different taxing implications. Let’s expand on this example with a third address. Address C falls within the same Pennsylvania zip code of 17055 and also is just across the street from the first two addresses, yet yields a third set of geocoding and tax information.

- C

714 W Main St

Mechanicsburg, PA, 17055

This third address when run through Symmetry Payroll Point yields different geolocation results despite its close proximity to the first two addresses.

- Geocoded location

County: Cumberland

Municipality: Borough of Mechanicsburg

School district: Mechanicsburg Area

PSD Code: 210601 (rate: 1.7%) - Employee tax

Pennsylvania State Tax: 3.07%

Pennsylvania SUI: 0.06%

Borough of Mechanicsburg—Mechanicsburg Area School District: 1.7%

Borough of Mechanicsburg—Mechanicsburg Area School District: $52.00

To summarize, three addresses in the same zip code, across the street from one another, yielded three completely different tax set ups resulting from their presence in three different municipalities—Township of Monroe, Township of Silver Spring, and Borough of Mechanicsburg — and two different school districts—Cumberland Valley School District and Mechanicsburg Area School District. These combinations of municipalities and school districts resulted in the differing EIT rates.