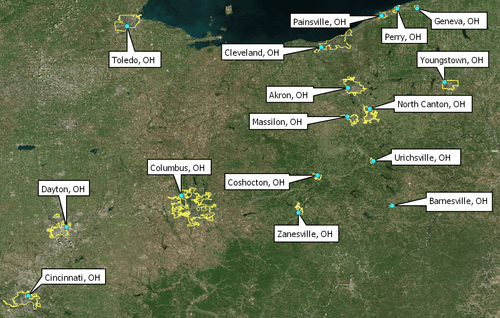

Spotlight on Ohio local taxes

Ohio has 649 municipalities and 199 school districts that have income taxes. Its state average local tax is second only to Maryland for highest local tax rates. In 2020, local rates range from 0 to 3%, with the higher rates in heavy metropolitan areas such as Cleveland. Columbus and Cleveland’s 2020 local tax rates are both 2.5%.

Ohio residents’ tax burden is further increased by the number of municipalities in Ohio levying local income tax. A staggering 649 out of 900-plus municipalities place a local tax on their residents. A total of 199 school districts also levy local income taxes in Ohio. Businesses and residents both pay municipal income taxes but businesses are only subject to the tax if they makes a profit in an applicable area for more than 20 days.

What is a JEDD?

A unique municipal tax only seen in Ohio is the Joint Economic Development District (JEDD) tax. A JEDD creates a partnership between a municipality and a township, with the goal of developing township land for commercial and industrial revenue. Each JEDD comes with an income tax. Legislation was passed in 1993 to begin the process of creating JEDDs. With each JEDD, a contract is needed between the municipality and the township. Communities within these areas then vote on the agreement, with a majority vote needed to pass. Once approved, JEDDs are operated by a five-person board including a representative from each township and city and at least one business owner and business employee within a company operating in the JEDD.

An example of JEDD and its tax is the Harrisburg JEDD tax. The city of Columbus administers the income tax for this JEDD at a rate of 1%, which is taxed on top of the Columbus rate of 2.5%.

Because these municipal taxes are levied on taxpayers based on where they work and where they live, some municipalities will offer tax credits to lessen the load. But just like the taxes themselves, the tax credit system is complicated. On top of that, only 63% of municipalities levying local taxes actually offer any type of credit - partial or full.

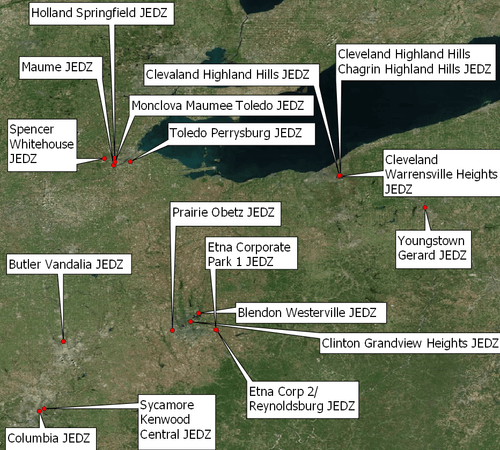

What is a JEDZ?

Similar to a JEDD, a JEDZ, which stands for “Joint Economic Development Zone” is an alliance between local government and a township in order to create efficiencies and reduce costs through shared services. An example of a JEDZ is Ohio’s Springfield Township’s Zone. In 2011, Springfield faced financial devastation after the Ohio State Legislature eliminated a majority of the township’s state funding. The legislation eliminated its estate tax, tangible personal property tax, and public utility tax.

In response, Springfield created a JEDZ with the Zone imposing a tax on the payroll and net profits of all businesses located in the zone. This tax is levied on both the employer and employees working in the Zone. The residents who do not work in a Zone are not taxed in accordance with the JEDZ. Revenue generated in the Zone continues current services and implements new initiatives for the improvement of the township.

JEDDs and JEDZs have a board of directors that work with a corresponding tax commissioner to create a map of the taxing area and a contract. Maps include the areas included in each JEDD or JEDZ with specific boundaries and parcel numbers of any parcel located in the JEDD or JEDZ. The board also notifies tax commissioners of which municipal corporation is charged with administering, collecting, and enforcing the taxes.

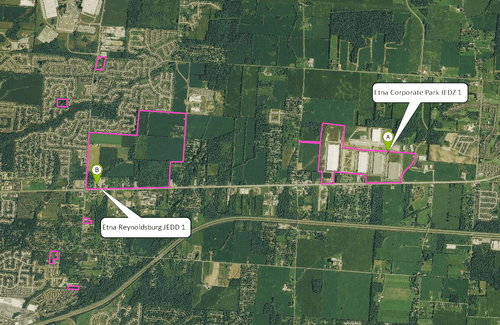

Where an employee works and lives determines the JEDDs or JEDZs and corresponding taxes that the employee is subject to. Below is an example of two addresses—very close to one another—in Ohio with different taxes due to their location in a different JEDD/JEDZ.

- Address A

175 Heritage Dr.

Pataskala, OH 43062

Employee taxes:Etna Corporate Park JEDZ1 Tax: 1.75%

Southwest Licking LSD Tax: 0.75% - Address B

8560 E. Main St.

Reynoldsburg, OH 43068

Employee taxes:Etna Reynoldsburg JEDD1 Tax: 2.0%

Reynoldsburg CSD Tax: 0.5%

What are revenue sharing areas?

Revenue sharing areas are another application of local income taxes in Ohio. Similar to a JEDD, a revenue sharing area is a district or neighborhood within Ohio that has partnered with its corresponding city to help drive revenue.

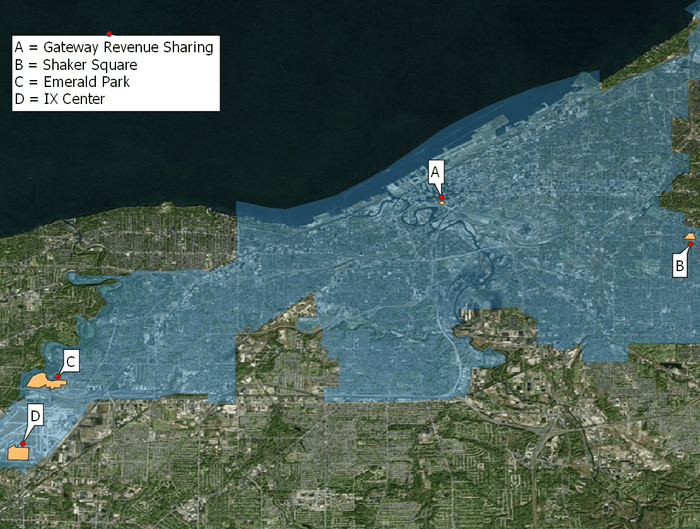

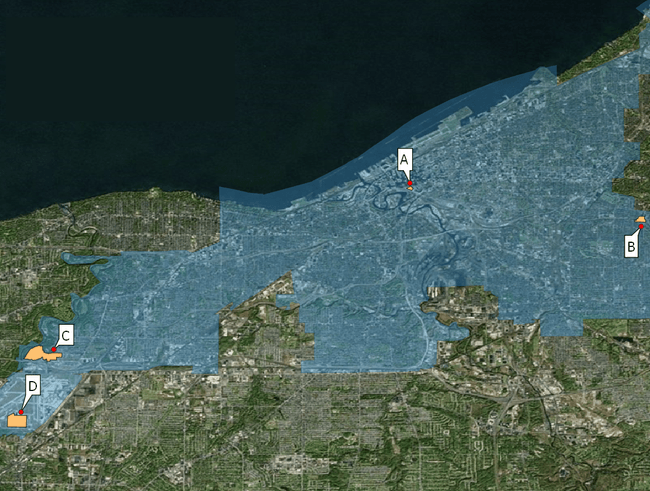

In Cleveland, there are four revenue sharing zones:

- Gateway District (the area in and around where the Cleveland Cavaliers play)

- IX Center

- Emerald Park

- Shaker Square

The city and these revenue sharing areas impose an extra income tax on anyone working within that area and then share the profits. Regular and seasonal employees are subject to the income tax, as well as independent contractors. The rate for all four is 2.00%. Each area must file their taxes through various forms throughout the year, and none receive a tax credit.

The ultimate aim of revenue sharing areas and JEDDs is to foster partnerships between cities, townships, neighborhoods, and the state for the overall benefit of Ohio.

Below is an example of the four revenue sharing areas in Cleveland, OH: