Compare W-4 Results With the Multi-State Calculator

We are excited to announce new Calculators By Symmetry features that allow employees to calculate paychecks using either the 2019 or 2020 W-4 as well as compare 2019 to 2020 W-4 results side by side.

We are excited to announce new Calculators By Symmetry features that allow employees to calculate paychecks using either the 2019 or 2020 W-4 as well as compare 2019 to 2020 W-4 results side by side.

Calculators by Symmetry: Using the multi-state calculator to calculate or compare 2019 and 2020 W-4 results.

We are excited to announce new Calculators By Symmetry features that allow employees to calculate paychecks using either the 2019 or 2020 W-4 as well as compare 2019 to 2020 W-4 results side by side.

Calculators by Symmetry are payroll tax modeling calculators that can be placed into your website. Each package, standard or premium, comes with our full collection of Symmetry calculators and tools and is available as widgets or through an API. Many service providers (payroll firms, PEOs, staffing companies) use the calculators on their website. Calculators enrich site content, increase traffic, and are sticky for visitors.

Calculate paychecks using either the 2019 or 2020 W-4

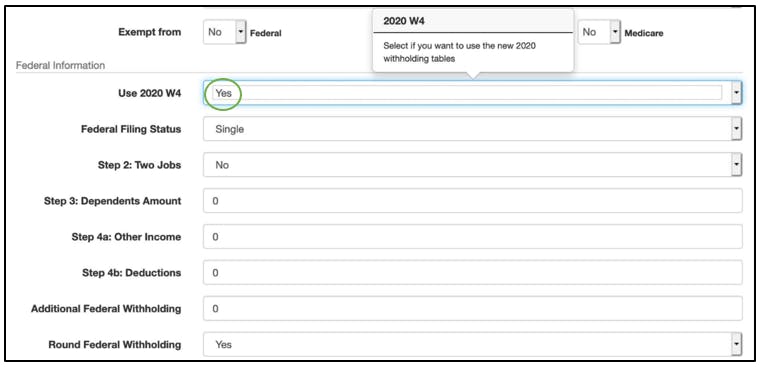

There is a drop-down feature allowing the user of the calculator to select whether they wish to use the 2019 or 2020 W-4 inputs, as shown below. Please note that for companies licensing the W-4 Assistant Calculator, which allows an employee to complete a W-4, the 2020 W-4 went live on January 1, 2020, and the 2019 W-4 will no longer be offered.

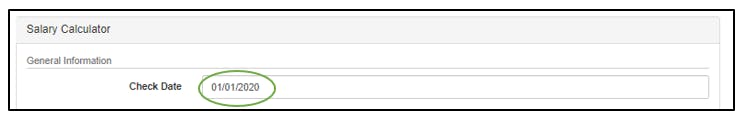

In order to view the 2020 W-4 inputs, first select a check date of 1/1/2020 or later.

When selecting "Yes" to view the 2020 W-4 inputs, you will now notice the following changes as shown below.

- Federal Filing Status has removed "Married using single rate" and added "Head of Household"

- # of Federal Allowances has been removed

- Steps 2-4b has been added

This new feature is live for all Calculators by Symmetry clients. Try it Free here.

Side by side comparison 2019 to 2020 W-4 results

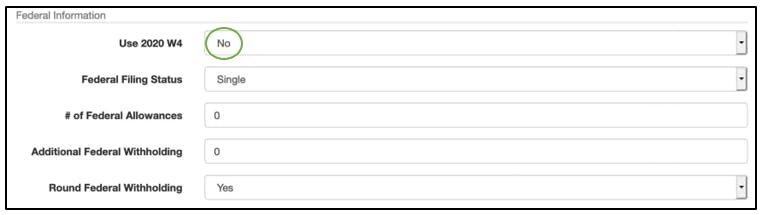

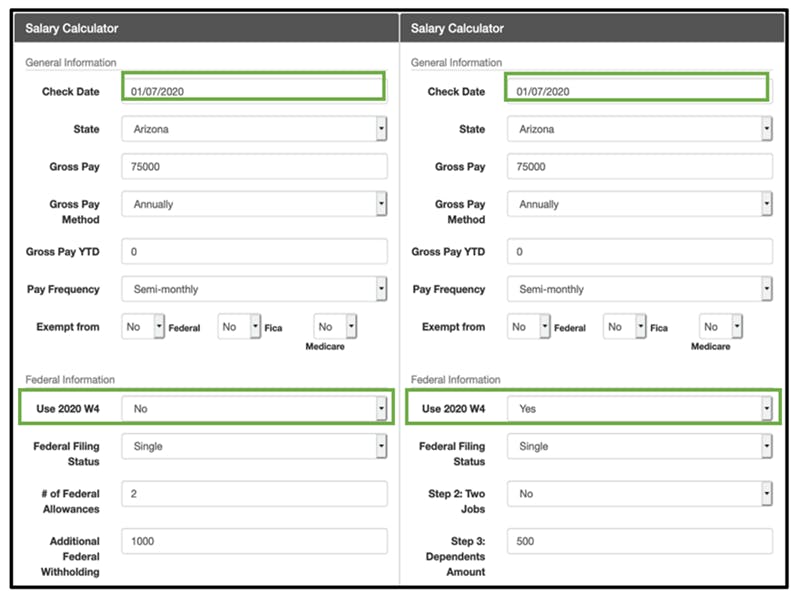

By using the Multi-Scenario calculator, you can compare the use of the 2019 W-4 versus the 2020 W-4.

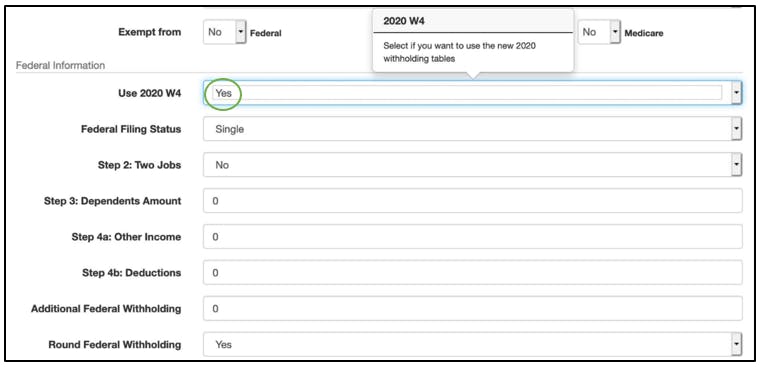

Two side by side 2020 check date calculations are shown below. The calculator on the left has the 2019 W-4 selected whereas the calculator on the right has the 2020 updated W-4 with automatically adjusted fields. This selection is done via the "Use 2020 W-4" drop down field within the calculator.

When a user clicks the “calculate” button, the results of each calculation will be displayed side by side. The Multi-Scenario calculator can also be used to show side by side results of check calculations in different years. For example, an employee may wish to compare his or her take-home pay from 2019 to 2020. Selecting check dates in different years will allow the employee to see the impact on withholding for different tax rates and/or withholding settings.

If you are not familiar with the Multi-Scenario calculator, have questions regarding the new features or would like to see a demo get started here.

Keep reading: related insights

Guides and tools

Latest articles

Payroll Insights Newsletter

Subscribe to our quartely newsletter for exclusive payroll insights.