Calculating Gross Pay and Net Pay

Discover the differences between gross and net pay, their impact on payroll, taxes and deductions and best practices for ensuring accurate payroll management.

In any organization, payroll is a critical function that directly impacts employees' salaries, benefits, and the company's overall financial health. Gross pay and net pay are critical concepts when calculating an employee's total earnings and take-home amount after deductions.

Knowing the difference between gross and net pay ensures accurate tax calculations, compliance with federal and state laws, and accurate financial planning. Employees must know gross and net pay when budgeting, negotiating salaries, and deducting health insurance, retirement contributions, and other benefits.

This article explains gross and net pay, calculations for salaried and hourly employees, standard payroll deductions, and the best practices to achieve payroll accuracy and compliance. By mastering these elements, businesses can streamline payroll operations, minimize errors, and nurture transparency in employee compensation.

Key Differences Between Gross Pay and Net Pay

Gross pay, or gross wages, refers to an employee's salary, tips, bonuses, commissions, and overtime pay before payroll taxes and other deductions. Gross pay should not be confused with gross income for businesses, which is the total revenue after subtracting the cost of goods sold, or gross profit or gross margin.

Net pay or final take-home pay is the remainder after all deductions, such as taxes, health care, and retirement contributions, which are withheld from an employee’s gross pay.

Importance of Gross Pay and Net Pay in Payroll Management

Gross pay calculates the firm's compensation expenses, including salaries, overtime, and bonuses. The data enables employers to budget accurately for overall payroll expenses, administer cash flow, and ensure financial planning is aligned with business goals.

The distinction between gross pay and net pay is also crucial for determining the correct amount of taxes to withhold from gross pay. Understanding taxable wages is the first step in complying with federal, state, and local tax laws.

Common errors associated with gross pay versus net pay include incorrect tax withholding, errors in benefit deductions, inconsistent payroll periods, and inaccurate handling of pre-tax and post-tax deductions. These issues can lead to discrepancies in gross and net pay that can have tax implications for both employee and employer and, if handled poorly, result in penalties and create vulnerability to litigation.

Calculating Gross Pay for Hourly Employees

For hourly employees, gross pay equals the number of hours worked in the pay period times the hourly salary.

Calculating Gross Pay for Salaried Employees

For salaried employees, gross pay is their annual salary divided by the number of paychecks they receive: 52 if paid weekly or 26 if paid every two weeks.

Common Deductions from Gross Pay

Taxes and Withholdings

Several categories of taxes are withheld from gross pay, including federal and state taxes. The amounts vary based on income, filing status, and the number of dependents claimed by employees.

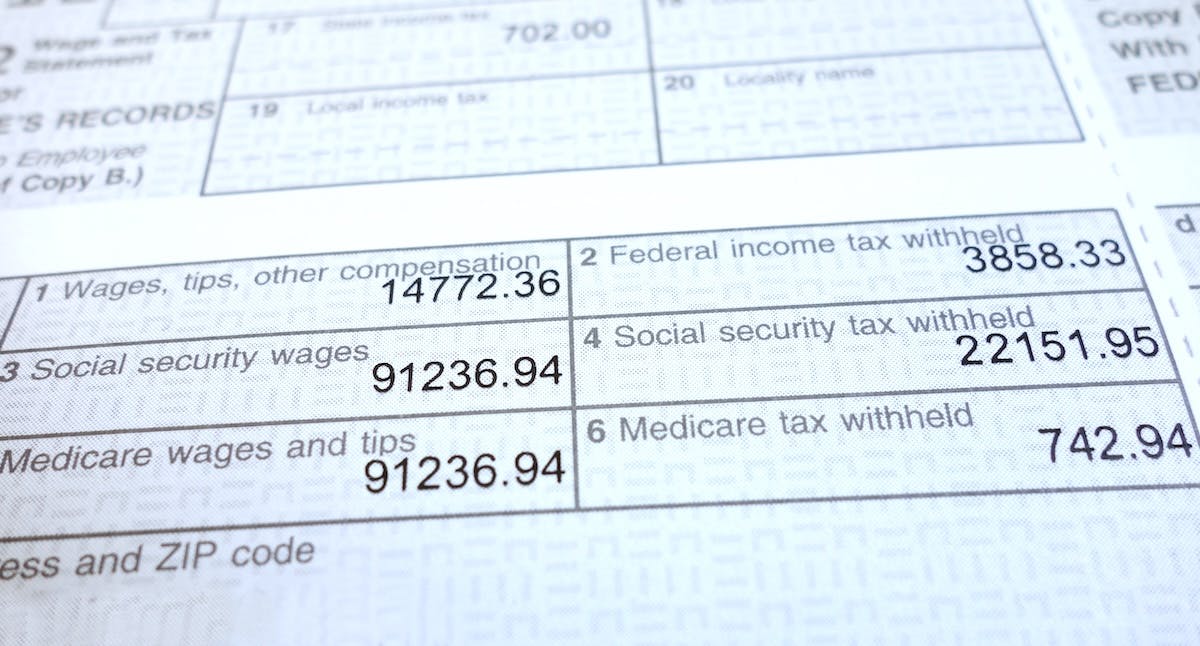

FICA Taxes: The FICA (Federal Insurance Contributions Act) includes Social Security and Medicare taxes. Employers pay their part of the taxes and withhold an equal amount from their employees’ wages. 6.2% of employees' gross wages are contributed to Social Security tax, and 1.45% of gross wages go to Medicare tax. The employer matches these taxes, which adds up to 15.3%.

Health Benefits Contributions

These contributions are not always deducted pre-tax; they vary by company policy.

Retirement Contributions

Contributions to retirement plans, such as 401(k)s, can lower employees’ taxable income. In 2024, employees could contribute up to $23,000, with the combined employee and employer contributions totaling $69,000. Employees aged 50 or older were eligible for an additional $7,500 in catch-up contributions.

Other Voluntary Deductions

Other deductions include wage garnishments or court orders requiring employers to withdraw a portion of a worker’s salary to reimburse a debt such as unpaid child support. Other deductions are life insurance premiums, charitable donations, and union dues.

Calculating Net Pay After Deductions

Determining net pay begins with gross pay, an employee's total wages before deductions. Next, mandatory deductions such as taxes and Social Security are subtracted. Then, voluntary deductions, like retirement contributions or health insurance, are removed. Other deductions are health savings accounts (HSAs) and flexible savings accounts (FSAs). These deductions are subtracted from the gross pay to arrive at net pay.

The Role of Payroll Experts in Managing Pay

Payroll managers supervise the entire payroll process. A key responsibility is maintaining and organizing payroll documentation while ensuring the process complies with legal and tax requirements. The manager must have in-depth knowledge of payroll rules and software and be adept at collaborating with departments and striving to improve procedures.

Other aspects of the job include administering timekeeping systems, supervising payroll transactions, purchasing and day-to-day management of payroll software, working closely with HR and other accounting staff, and being responsible for resolving payroll-related issues.

In case of an audit, the payroll manager is a key player and works with auditors to ensure compliance. In larger companies, the payroll manager often supervises several payroll specialists, but smaller companies usually have a small staff, just one or two employees.

Impact of Gross and Net Pay on Taxation

Gross pay includes base salary or hourly wages, overtime, bonuses, and commissions. Employers deduct required items such as federal and state taxes, Social Security, Medicare, and voluntary benefits like retirement and health insurance premiums.

Since these items are taken out before tax, they reduce taxable income and, ultimately, net pay. Stipends for reimbursement for expenses such as classes, wellness programs, or items such as monitors for home offices are added to gross pay. In most cases, these stipends are taxable and don’t reduce net pay like pre-tax benefits.

Influence on Employee Take-Home Pay

Net pay is the amount of money an employer pays an employee or non-employee contractor after deductions and withholdings have been withheld. Net pay equals gross pay, or wages, minus deductions. For the employee, net pay is also known as net income or take-home pay.

Several voluntary and nonvoluntary items are withheld from gross pay and reduce net pay.

- Federal income tax: Federal income tax is calculated using a set of IRS wage brackets.

- State income tax: These vary by individual state law. Some use state tax brackets, some states have flat tax rates, and others don't levy state income taxes.

- FICA taxes: Employers withhold payroll taxes based on the Federal Insurance Contributions ACT (FICA), Social Security tax, and a Medicare tax.

- Wage garnishments: Employers must withhold a percentage of an employee’s earnings upon receiving a court order for payment of debts, including back taxes, child support, or alimony.

- Benefits deductions: Healthcare premiums, specific retirement plan contributions, HSA/FSA savings, and other payments are pre-tax deductions taken from gross pay.

- Charitable contributions: Donations to charitable causes and organizations can be withdrawn from an employee's paycheck.

- Union dues: Union members pay dues from their gross wages.

- Form W-4 information: Information includes the employee’s filing status (single, married, etc.), number of jobs, total income, number of dependents, extra withholding adjustments, and all impact net pay. Employees can request to withhold additional tax from gross pay.

Significance of Financial Planning for Employees

- Budgeting and Financial Planning: Understanding the difference between gross pay and net pay enables employees to budget and plan their finances accurately. It details how much can be spent or saved.

- Understanding Deductions: Employees can also understand which deductions are being taken from their paychecks and why, which promotes transparency and financial literacy.

- Tax Compliance: Employers use gross pay to calculate and withhold taxes, so understanding the difference helps ensure accurate tax reporting and compliance.

- Negotiating Salaries: Employers will typically offer new employees a salary, which is the gross amount. As a result, employees must understand that there is a large gap between the offer and take-home pay when negotiating wages.

Optimizing Payroll Systems for Accuracy

To optimize payroll systems for accuracy, corporations have to automate the processes and integrate with HR and accounting systems. Businesses also have to conduct audits regularly and empower employees to check their information via self-service options.

Adopting payroll software to automate calculations for wages, deductions, and tax withholdings can help reduce manual errors.

Synching payroll with time and attendance systems automatically captures employee hours and other relevant data—another method to reduce manual data entry and potential errors.

Integrating Payroll with Other Systems

- HR Integration: Connecting payroll systems with HR systems to safeguard employee data is consistent and up-to-date, avoiding incorrect employee information errors.

- Accounting Integration: Integrating payroll with accounting software can improve financial reporting and ensure financial statements are accurate.

- Time and Attendance Integration: Integrate payroll with time and attendance systems to automatically capture employee hours and other relevant data, which can decrease manual data entry and potential errors.

Ensuring Compliance with Payroll Regulations

Overseeing payroll also includes complying with federal, state, and local laws. Failure to comply with payroll rules and regulations can prompt significant fines, lawsuits, and reputational damage. In 2023, the U.S. Department of Labor recovered over $274 million in back wages for nearly 152,000 workers due to payroll violations. In addition, IRS penalties for payroll tax errors can climb to 15% of the unpaid wages. Violating FLSA laws may compel businesses to pay large fines for unpaid overtime. Employee misclassification fines can lead to audits and cost businesses thousands per worker.

Misclassifying employees can lead to violating these rules, so companies must keep current on all federal, state, and local tax regulations. Payroll rules vary from state to state, and missing quarterly tax deposit deadlines can trigger IRS penalties.

The next set of requirements is accurately tracking workers' regular hours and overtime work (time-and-half for over 40 hours in a week).

Companies can purchase time-tracking software to complete these chores quickly and reduce manual errors. Companies should file pay stubs, payroll registers, W-2s, W-4s, and I-9 forms to maintain proper payroll records. Payroll records should be stored for at least three years, according to FLSA requirements.

Staying up to date with state and federal payroll law changes is crucial. Employers can subscribe to IRS and state tax agency newsletters and review Department of Labor updates regularly. Companies should also create a compliance calendar to track payroll and tax deadlines.

Audits should be conducted quarterly to ensure accurate employee wages and spot errors before tax deadlines.

Gross Pay vs. Net Pay: Frequently Asked Questions

What is the difference between gross pay and net pay?

Gross pay is the total amount an employee earns before any deductions. It includes salary, overtime, bonuses, and commissions.

Net pay, or take-home pay, is the amount left after taxes and other deductions are subtracted from gross pay.

Why is understanding gross and net pay important?

Knowing the difference ensures:

- Accurate tax calculations and withholdings

- Compliance with federal, state, and local laws

- Better financial planning for both employers and employees

- Informed salary negotiations

How is gross pay calculated for hourly and salaried employees?

- Hourly Employees: Gross pay = Hours worked × Hourly rate

- Salaried Employees: Gross pay = Annual salary ÷ Number of pay periods (e.g., 52 for weekly, 26 for biweekly)

What deductions are typically withheld from gross pay?

Mandatory Deductions include federal and state income taxes, FICA taxes: Social Security (6.2%) and Medicare (1.45%), or court-ordered wage garnishments.

Voluntary Deductions include health insurance premiums, Retirement contributions (e.g., 401(k)), and Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). They also include charitable donations and union dues.

How is net pay calculated?

Net pay = Gross pay − (Mandatory deductions + Voluntary deductions).

This includes taxes, benefits, garnishments, and other withholdings.

How do gross and net pay affect taxes?

- Gross pay is the starting point for tax calculations.

- Pre-tax deductions (like retirement contributions) reduce taxable income.

- Stipends for reimbursements are usually taxable and added to gross pay.

What common errors occur in payroll processing?

- Incorrect tax withholdings

- Miscalculations of benefits and deductions

- Inconsistent payroll periods

- Misclassification of employees

- Failure to apply pre-tax and post-tax deductions correctly

Conclusion: Effective Management of Gross and Net Pay

Managing gross and net pay effectively is crucial to ensuring payroll accuracy, compliance, and financial stability for companies and employees. Employers must understand and comply with all payroll deductions: federal, state, and local tax obligations, insurance, and employee retirement contributions. Companies must comply with IRS and FLSA rules and regulations to help mitigate business risks, optimize cash flow, and maintain accurate financial records.

Knowing the difference between gross and net pay fosters better financial planning, tax preparedness, and informed salary negotiations for employees.

Employers can further enhance payroll efficiency by automating payroll systems, synching payroll with HR and accounting systems, and staying current with federal, state, and local tax regulations.

Businesses can avoid costly errors, strengthen employee trust, and maintain a smooth payroll process by implementing best practices in payroll management, i.e., regular audits, transparent compensation communication, and proactive compliance monitoring.

Keep reading: related insights

Latest articles

Payroll Insights Newsletter

Subscribe to our quarterly newsletter for exclusive payroll insights.