What Payroll Providers Should Know About FUTA Compliance in 2025

To start, let’s define FUTA: The Federal Unemployment Tax Act (FUTA) is a US federal law enacted in 1939 that imposes a payroll tax on employers. FUTA funds state agencies and unemployment insurance programs—essentially, employee unemployment benefits.

What is FUTA?

Like individuals, employers must comply with local, state, and federal payroll tax regulations—including FUTA, State Unemployment Tax Act (SUTA), the Federal Insurance Contributions Act (FICA), and more. That means accurate tax calculation, timely filing, and staying ahead of changes to avoid penalties.

But in reality, it’s payroll providers who are responsible for ensuring employers aren't placed in this challenging position.

If you’re a payroll provider, you know the responsibility can be daunting. And even if you use a third-party solution like Symmetry to ensure compliance and handle payroll tax calculations, you need some knowledge of these laws to truly do right by your customers.

That’s because white-glove service means going the extra mile to educate and guide your customers through their questions and concerns, and it’s what will set you apart from your competition.

When your clients come to you with FUTA-related questions, can you walk them through the details? Do you know how quarterly deposits, taxable wages, and credit reduction states work?

To help you out, this article covers everything you need to know about one payroll tax law in particular: FUTA.

Let's break down what the FUTA tax is, how it works in 2025, and why it matters to your role.

How does FUTA work?

Employers who pay wages of $1,500 or more (quarterly, not annual wages) are required to report and make quarterly payments toward FUTA taxes. Typically, this tax rate is 6% of the first $7,000 of an employee's wages or annual salary.

As of 2025, the current FUTA tax rate remains 6.0%, which equates to a maximum FUTA tax of $420 per employee per calendar year.

However, most employers qualify for a tax credit of up to 5.4% for timely payment of state unemployment insurance taxes, reducing their effective FUTA tax rate to 0.6%, or $42 per employee.

To be eligible for the maximum credit, employers must:

- Pay your state unemployment taxes in full.

- Pay your state unemployment taxes by the due date of your tax Form 940.

- Pay your state unemployment taxes on all the same wages subject to FUTA tax, and

- Ensure your state is not classified as a credit reduction state.

Without these, the FUTA credit can be reduced, increasing the employer's FUTA obligation and affecting the amount due with the quarterly payment or year-end tax return.

As you can see, FUTA taxes can be complex, and there is valuable financial assistance to be had when they’re navigated correctly. That’s why it’s absolutely essential for payroll providers to accurately apply the correct FUTA rate for each employer they serve.

FUTA Exemptions and Special Rules

Notably, there are some exemptions to FUTA taxes, including religious organizations, government entities, charitable nonprofits, educational institutions, railroad companies and workers, household employers, and independent contractors.

By accurately applying these exemptions, payroll providers can help minimize FUTA liability, and it's your role to guide them through this process.

Notably, railroad companies and workers are exempt from FUTA. This means railroad companies don’t have to pay FUTA taxes, and their workers aren’t eligible for federal unemployment program benefits.

However, they might still be subject to other industry-specific tax regulations and benefits, like the Railroad Retirement Tax Act (RRTA) and the Railroad Unemployment Insurance Act (RUIA).

You can refer to the quick list below for some types of employers and wages that are exempt from FUTA:

- Government entities (federal, state, and local)

- 501(c)(3) nonprofit organizations

- Certain household employees

- Independent contractors

- Self-employed individuals

- Religious and educational institutions

- Railroad companies and their workers, who are covered under the Railroad Retirement Tax Act (RRTA) and the Railroad Unemployment Insurance Act (RUIA)

FUTA tax credit reductions

Things get more complex when states borrow money from the federal government to pay unemployment claims. If a state fails to repay its loan under the Social Security Act Title XII by November 10 of the tax year, it’s classified as a credit reduction state. Employers in these states lose part of their FUTA credit.

Under Sections 3302(c)(2) and 3302(d)(3) of the Federal Unemployment Tax Act, a reduced credit increases the employer’s effective FUTA rate and results in a higher FUTA tax liability.

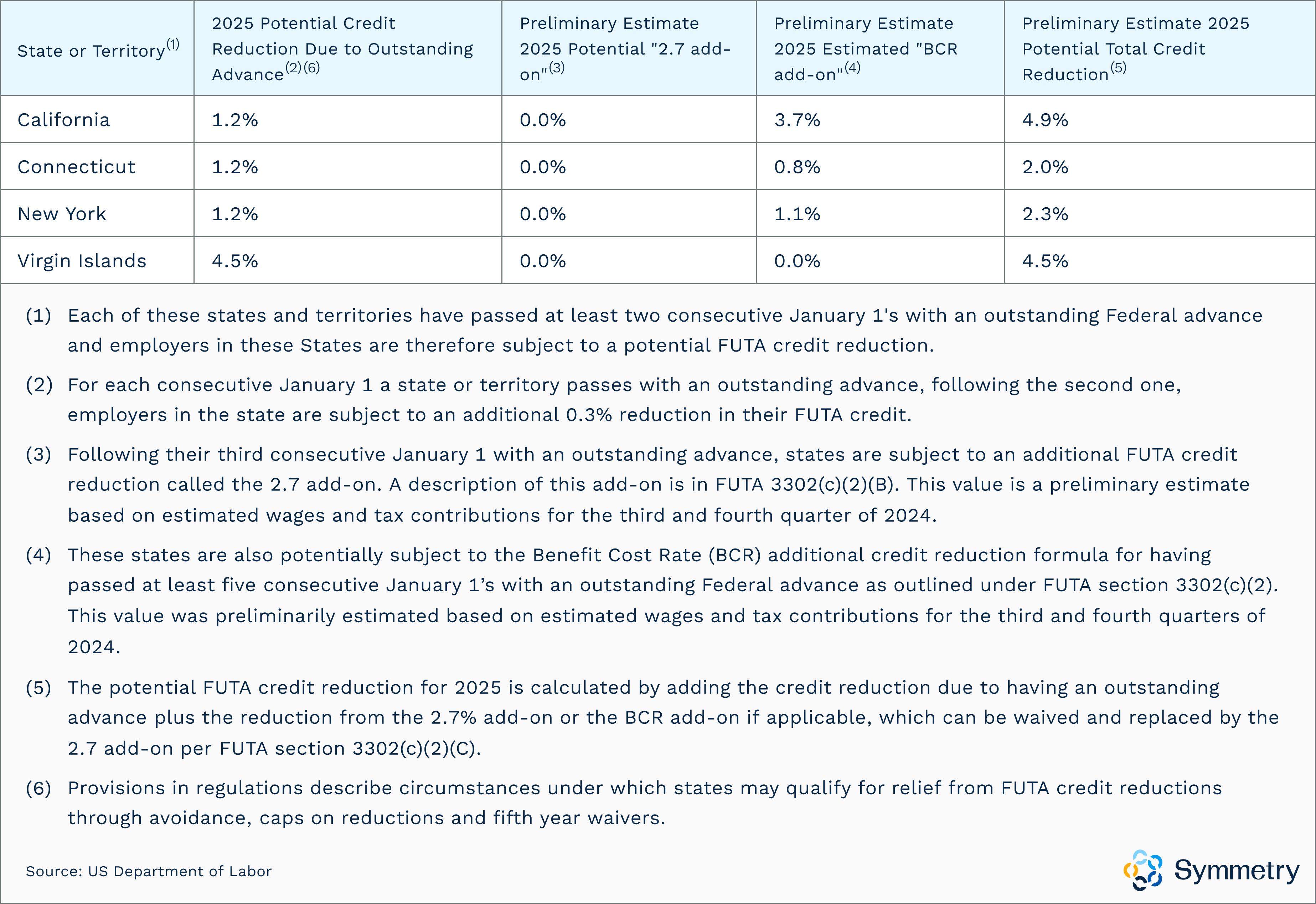

According to the US Department of Labor, the following states had a Social Security Act Title XII—which covers advances to state unemployment funds—balance as of January 1, 2025. If these states did not repay the outstanding advance by November 10, 2024, employers in these states faced a reduction in FUTA credit on their IRS Form 940:

Chart for FUTA potential total credit reduction in 2025

Then, if your customer is subject to a credit reduction because they are in a state with an unpaid loan (this includes California, Connecticut, New York, and the U.S. Virgin Islands in 2024), you can help them account for the credit reduction on their Schedule A (Form 940). The credit reduction amount will be due with the employer’s fourth quarter deposit.

What’s the impact of FUTA tax on payroll and people tech providers?

It’s simple, really: Like any payroll tax, the importance of FUTA comes down to compliance. As a people tech or payroll provider, you must accurately calculate FUTA taxes for your customers and possibly help them file Form 940 annually in their tax returns.

If you get this wrong, your customers will face penalties, which, in turn, will shake their confidence and trust in your platform.

Here’s what the IRS has to say about federal taxes, including FUTA:

“Even though the employer may forward the tax amounts to the third party to make the tax deposits, the employer is the responsible party… The employer may also be held personally liable for certain unpaid federal taxes.”

That includes federal unemployment taxes. If an employer’s quarterly deposit is late or underpaid, they could face a Failure to Deposit Penalty ranging from 2% to 15% of the unpaid amount, plus interest.

FUTA Tax Compliance for Payroll Providers: What You Need to Know in 2025

FUTA interacts with many moving parts. In addition to the standard complexities of FUTA compliance, it’s worth remembering that employers may also be responsible for unemployment benefits tied to prior claims. These claims can involve temporary employees, changes in wage base calculations, and eligibility reviews tied to benefits for workers.

Payroll providers must ensure all FUTA-related tax requirements are met, particularly when assessing liability from a previous quarter or preparing to file a tax return. When in doubt, it’s wise to consult a tax professional or seek legal advice, especially when rules vary across state lines or when calculating the employer’s FUTA liability accurately.

Below is a list of some critical considerations to keep in mind regarding FUTA:

- Quarterly deposit thresholds (more than $500 triggers mandatory payment).

- Legal holiday extensions to deposit due dates.

- How to calculate FUTA for agricultural workers and household employers.

- Whether wages in a given previous calendar quarter push the employer over the filing threshold.

- When your client operates in multiple states with different unemployment insurance rules, including surrounding extended unemployment benefits and temporary employees.

- When to recommend a tax professional for complex scenarios.

- When to contact a lawyer for legal advice.

While Symmetry helps you keep up with every FUTA rule and tax requirement, understanding the “why” behind the rules sets you apart.

For example, with temporary employees, missteps in classification or payroll timing can trigger unexpected unemployment benefits claims or late deposit penalties. A short-term staffing arrangement that crosses quarters could increase FUTA exposure if the wages exceed the wage base or if FUTA liability thresholds are miscalculated.

The same applies to employers who experience fluctuating headcounts or operate seasonally—small oversights can quickly turn into large compliance issues.

Helping clients recognize these nuances is part of the value you bring as a payroll provider. When you proactively explain how FUTA tax liability can change due to staffing patterns or extended unemployment benefits, you're delivering the kind of guidance that builds long-term trust.

Get FUTA (and All Payroll Taxes) Right with Symmetry

Between federal income tax, Social Security, FUTA, and state unemployment insurance taxes, keeping up with compliance is no small task.

But you don’t have to manage it alone. Whether you serve startups, business owners, agricultural employers, or enterprise clients with complex unemployment systems, our tools reduce risk and free up your time.

Industry-leading people tech providers like Gusto and UKG build their payroll products on Symmetry’s tax compliance infrastructure.

We handle the heavy lifting of keeping up with all tax rates, current tax advice, auditing calculations for compliance, and supporting you throughout the process, so you can focus on creating a remarkable platform and winning more customers.

Frequently Asked Questions

What is FUTA, and who pays for it?

The Federal Unemployment Tax Act (FUTA) is a payroll tax that employers pay. FUTA funds unemployment benefits.

What is the current FUTA tax rate and wage base limit?

The current FUTA tax rate is 6.0% on the first $7,000 of an employee’s wages. There is a potential credit of up to 5.4% when state unemployment taxes are paid on time.

How is FUTA different from SUTA (state unemployment tax)?

FUTA is the federal unemployment tax, while SUTA is a state unemployment tax. Note, employers tend to pay both with SUTA payments, helping to reduce FUTA liability.

What happens if a company does not file or pay the FUTA tax on time?

The IRS can and will impose penalties for late payments, late filings, or underpayments.