Defining the Urban Growth Boundary of Oregon

The Urban Growth Boundary of Oregon helps control urban expansion onto farm and forest lands, and ultimately deter an unsettling urban sprawl that could damage natural resources.

Across America, there are unique taxes, whether at a state or local level. In 1973, Oregon’s legislative body adopted the state’s first land use planning laws. Thus, the Urban Growth Boundary (UGB) of Oregon was born. Since then, each city and metropolitan area has created their own UGB in Oregon. These boundaries help control urban expansion onto farm and forest lands, and ultimately deter an unsettling urban sprawl that could damage natural resources.

The Metro Council of Oregon was founded in 1979, and with it, a Metro legal boundary. The council manages Oregon’s UGB. Every six years, the council reviews and reports on the land supply usage. Those who live within the boundary can vote on representatives to serve in the Metro Council. Those who live within the boundary - or any other UGB - are subject to that boundary’s taxes.

Boundary lines are important when considering what taxing authority have control over residents. For example, citizens who live inside the UGB but outside the Metro legal boundary are not subject to Metro taxes or regulation. Instead, these residents would pay the UGB taxes. These taxes include payroll taxes that employees and employers both pay.

The Metro Council can practice its taxing authority only within the Metro legal boundary. However, state law permits the Metro Council jurisdiction over UGB decisions, even if that land is outside the Metro legal boundary. Areas like these are considered transition zones. Areas can be annexed to the Metro council, too, meaning the council would have regulatory and taxation authority of those areas.

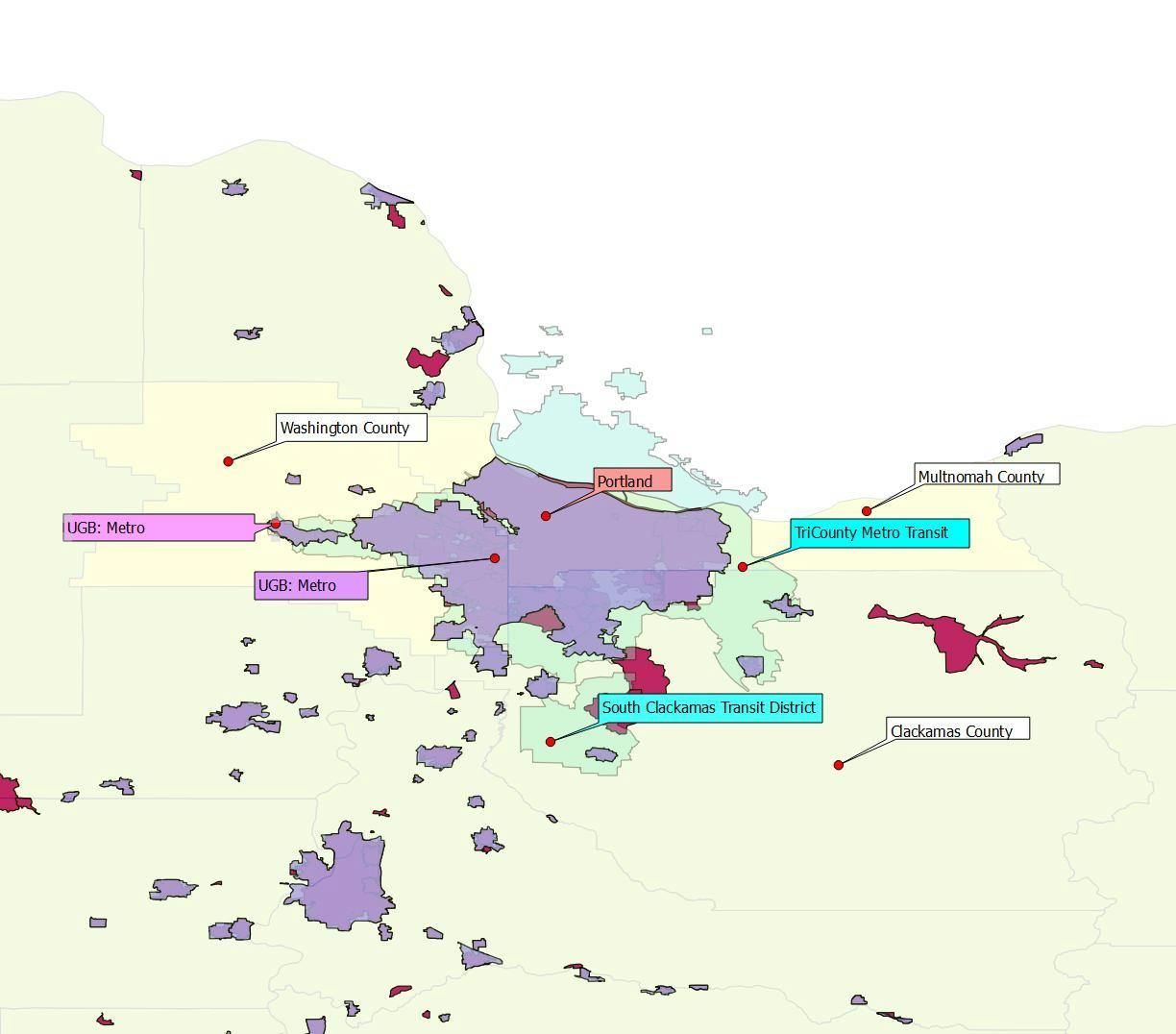

With so much going on, the UGB can be confusing. Take a look at the map below that illustrates this:

The UGB (the purple layer) covers three counties and a portion the Transit District. Notice, how the UGB part that is applicable to Portland is called 'Metro?' Two chunks are not attached and some portions of Portland (the red layer) are not included.

The UGB of Oregon is a perfect example of why location accuracy is integral when dealing with taxation. Utilizing just a zip code could still end up with incorrect information. Geolocation, and the usage of latitude and longitude coordinates, is the best way to ensure the correct tax rates. Practice it now with our local tax identifier.

Keep reading: related insights

Guides and tools

Latest articles

Payroll Insights Newsletter

Subscribe to our quartely newsletter for exclusive payroll insights.