How to Master Multi-State Payroll Tax Compliance

Even when there’s only a single state to consider, payroll taxes can be complicated. However, when you strive to achieve multi-state payroll compliance, the complexities can really start to compound. Find out how Symmetry can help you keep your customers compliant.

Payroll tax laws and regulations change frequently. However, a rapidly evolving regulatory environment is never a valid excuse for falling out of compliance. Whether non-compliance is due to blatant criminal fraud or a simple mistake, it’s a serious matter in the eyes of the law. Then there are the inherent complexities of hybrid work and remote employees to consider.

When you’re providing multi-state payroll tax services, trying to manually keep up with every tax law change across state and local tax jurisdictions can be a major burden.

In this article, we explore some of the reasons multi-state payroll compliance is so complex, then uncover solutions that can help your teams focus on what they do best: building innovative payroll products and people tech platforms.

What makes multi-state payroll tax so complicated

Successfully navigating the world of multi-state payroll tax compliance is one of the most complex challenges a payroll provider faces. With different rules and rates across 50 states, various districts, and thousands of smaller, local tax jurisdictions—in addition to double taxation scenarios, such as payroll tax requirements for employees working in multiple states—there’s much to consider.

1. Different states have different income tax rates

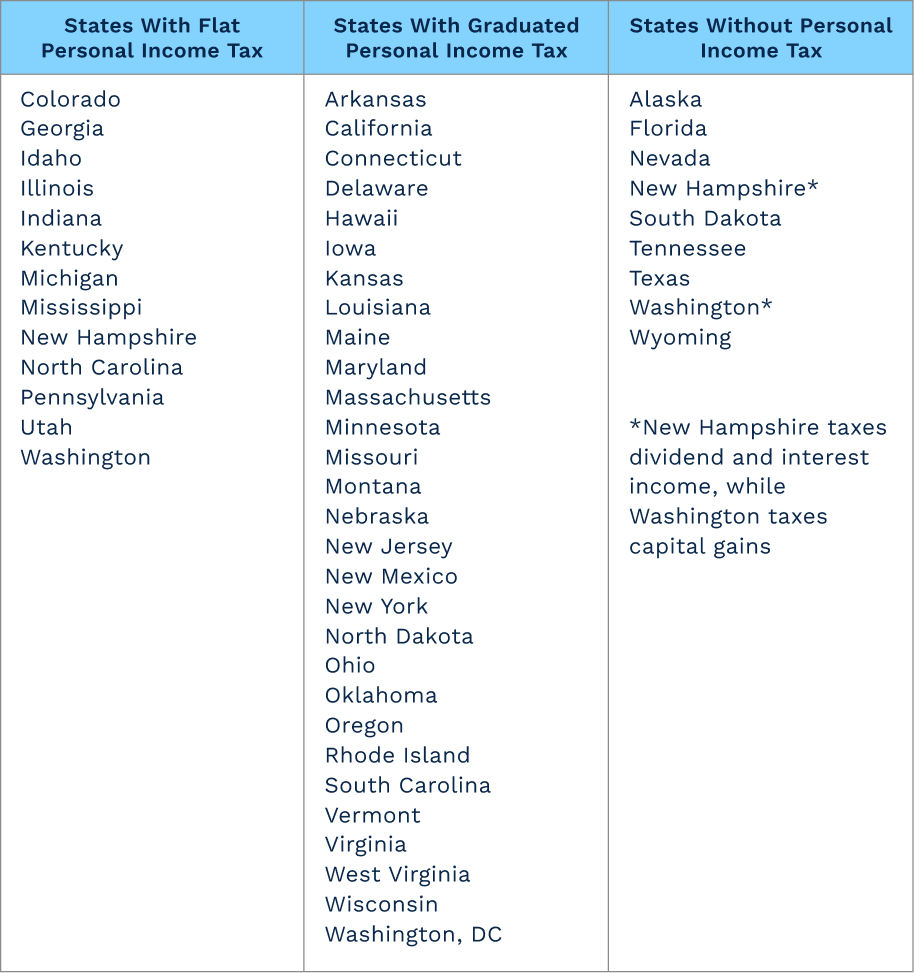

Across the country, different states have different payroll tax rates and rules for calculations. For example, at the time of publication (2024), most states and Washington, D.C. have tax rates that vary from one income level bracket to another. Meanwhile, 13 states have flat income tax rates across all income levels. Finally, seven states don’t tax personal income at all.

To complicate matters further, an employee's state income tax may be affected by several state laws and tax regulations all at once. For example, if an employee works for a multi-state employer, travels for work, or lives and works in a different state than their out-of-state employer’s headquarters (whether due to proximity, such as employees working in New York and living in Connecticut, or due to a work-from-home agreement), various (often complex) nuances can come into play.

However, there are exceptions to the rule. Some states and Washington, D.C. offer reciprocity agreements to eliminate double taxation concerns for nonresident employees:

- Arizona

- Illinois

- Indiana

- Iowa

- Kentucky

- Maryland

- Michigan

- Minnesota

- Montana

- New Jersey

- North Dakota

- Ohio

- Pennsylvania

- Virginia

- Washington, D.C.

- West Virginia

- Wisconsin

You can file paperwork with their respective tax offices; however, each jurisdiction’s reciprocity agreement only applies to a select group of neighboring states.

A note on hybrid work: Even if an employee works at a company headquartered in the same city and state as their home address, a hybrid work agreement could still mean they’d be impacted by additional jurisdictions if their home address and work address fall under the domain of different tax offices. According to a survey by Webex, 78% of employers based in the Americas believe hybrid work schedules will become typical arrangements within the next two years. Hybrid employees might work from different local districts, different cities, or different states.

2. You have to determine every employee’s applicable tax jurisdictions based on both their home and work addresses

The rate at which an employee’s income is taxed as well as their benefit withholdings are determined by where they reside, and in some cases like in an Ohio JEDD, where they work. Their jurisdiction, especially on the local level, can change from one street to another.

You could use a digital map or app, or reference simple postal code directories, to try to determine an employee’s tax jurisdictions, but errors are typical among these sources.

That’s why Symmetry products feature geocoding technology to ensure every employee is associated with the right tax jurisdictions—down to the residence. The advanced functionality combines tax data from the Symmetry Tax Engine with proprietary mapping technology and geospatial boundary maps to return up-to-date tax accuracy.

3. Calculating and withholding state unemployment taxes is also highly variable

The State Unemployment Tax Act (SUTA), also known as state unemployment insurance (SUI) is a state payroll tax designated to fund unemployment. To file and withhold accurate SUI taxes from employees’ paychecks, you have to consider the bases of taxable employee wages and each employers’ SUI rate, which depends on where their employees live. The SUI taxes are the responsibility of your customers (the employers), and if they’re in New Jersey, Alaska, and Pennsylvania, their employees are also responsible for paying an additional SUI fee.

All of the aforementioned multi-state payroll tax considerations contribute one layer of complexity after another, compounding the risk for error. Still, adhering to the right state income tax withholding requirements, accurately filing the proper paperwork, and remitting tax payments on time is paramount.

How to stay compliant: multi-state payroll best practices

Like anything else, it’s considerably easier to be successful in staying compliant when you have the right approach in place. Use these best practices and tech solutions to transform how you manage your customers’ multi-state payroll taxes.

Automate federal, state, and local tax requirements

Supercharge your payroll product with tax compliance infrastructure designed to calculate and withhold taxes for every state an employee has done business in to serve your customers with greater accuracy and ease.

Partner with a well-connected tax expert

Some tax compliance solutions rely solely on information pulled from the internet, which might not be entirely reliable. When you partner with a true multi-state payroll tax expert, you can benefit from the ease and accuracy of their compliance infrastructure and feel reassured by the added layer of their deep, trusted relationships at local tax offices across the country. Reliable information is key for payroll professionals.

Understand that there are always exceptions to the rules

When you’re managing payroll taxes in the context of multiple states, you’ll notice there are often exceptions to every rule. For example, a few states withhold for temporary disability. Similarly, a growing number of states have special paid family medical leave programs that require their own tax withholdings. In other words, don’t make assumptions about payroll tax requirements for your customers, as they vary so widely.

Compliance—minus the complexity

The myriad challenges of multi-state payroll management are clear; however, compliance does not need to be so complex. The Symmetry Tax Engine offers a frictionless payroll software solution that helps your products automate all of the calculations you need to stay compliant across multiple states and thousands of local tax jurisdictions. It’s powerful, fast, secure, and updated on a regular basis to take the guesswork and stress out of payroll taxes. Navigate over 7,400 tax jurisdictions for your customers with confidence.

Keep reading: related insights

Guides and tools

Latest articles

Payroll Insights Newsletter

Subscribe to our quartely newsletter for exclusive payroll insights.