Symmetry Software Announces New Minimum Wage

Symmetry Software has announced the launch of a new stand-alone minimum wage lookup tool called the Symmetry Minimum Wage Finder.

Symmetry Software has announced the launch of a new stand-alone minimum wage lookup tool called the Symmetry Minimum Wage Finder to aid developers and employers in ensuring minimum wage rates are accurately applied across their products and workers.

“We’ve seen great enthusiasm from companies that have delivery workers who may hit multiple minimum wage jurisdictions throughout the course of their daily routes.”

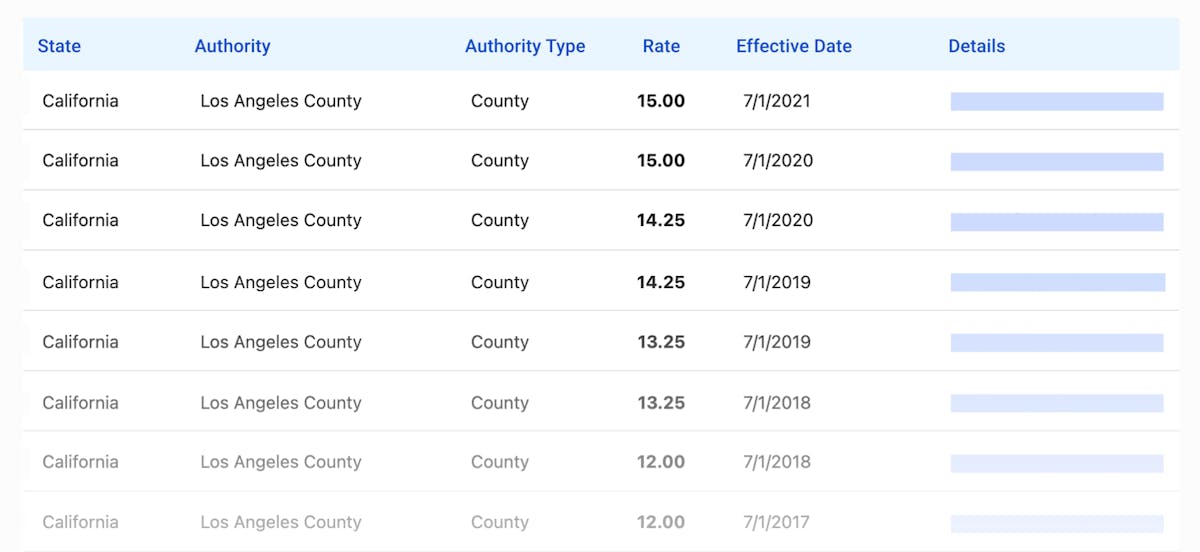

The Symmetry Minimum Wage Finder tracks the minimum wage rates across the country by state, city, job type, job function, effective date, and more. It also identifies the proper minimum wage rate for employees based on their work address.

So far in 2022, 26 states and 64 city and county minimum wage rates have been implemented or increased, putting strain on the software and service providers and compensation professionals responsible for staying compliant in an increasingly complex environment, one where workers frequently change their work locations.

Using the same proprietary technology in the Symmetry Tax Engine to pinpoint taxation requirements to an exact set of latitude and longitude coordinates, Symmetry Software created this new tool to quickly and accurately identify minimum wage requirements for jurisdictions helping service providers and employers transform the way they support wage rates.

“We are excited to offer our new Symmetry Minimum Wage Finder. It is the perfect tool for companies that have hourly workers who earn wages in multiple locations on a daily basis. It’s been exciting to see early adopters of Symmetry Minimum Wage Finder implement the tool to accurately determine the correct minimum wage rates in complex areas such as cities around Chicago and cities throughout California.”

Symmetry Minimum Wage Finder API & Portal

The new version of Symmetry Minimum Wage Finder has an API and web-based Portal interface. It allows the user to hone in on specific minimum wage rates to ensure employees are paid the minimum wage when appropriate. It also features leading-edge mapping technology and geospatial boundary maps for jurisdictions, making researching complex wage scenarios quicker.

The API is ideal for developers building integrations into payroll or other financial systems and for large employers wanting to appropriately set up new employees’ compensation or audit the minimum wage rates of existing employees. It integrates minimum wage rate data directly into an HR or payroll system or application and retrieves real-time minimum wage results by the employee.

The Portal is a modern interface that allows payroll or compliance professionals to confirm wage rates are in compliance as a position is posted or apply minimum wage rates precisely rather than on expectation.

Symmetry Minimum Wage Finder Maps & Batch

The Symmetry Minimum Wage Finder Portal consists of both a maps and batch interfaces to identify minimum wage jurisdictions and quickly and efficiently process multiple employee records. The Maps interface displays shape-file boundaries of minimum wage jurisdictions, making researching complex wage scenarios quicker. Batch allows employers to process a large group of addresses at one time, receiving customized minimum wage reports in return.

“Another great feature is access to minimum wage rates across the country in a downloadable format. Access to wage data in this format allows our clients to forecast and plan for future workforce costs. It's a uniquely powerful tool and we are excited about all the new capabilities it will provide our clients.”

Symmetry Minimum Wage Finder is on top of all minimum wage updates and will help companies ensure employees are paid the minimum wage when appropriate and help avoid legal issues and fines by remaining compliant with the ever-changing wage rates. Get started today! Try a free trial of Minimum Wage Finder.

Keep reading: related insights

Guides and tools

Latest articles

Payroll Insights Newsletter

Subscribe to our quartely newsletter for exclusive payroll insights.