API-powered payroll tax updates for applications & developers

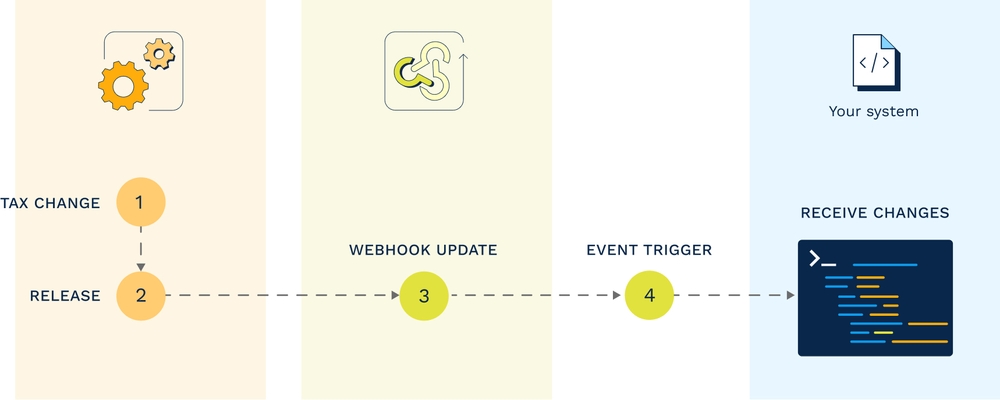

Webhooks by Symmetry allows your application to automate your payroll tax changes with the Symmetry Tax Engine® API. Easily register webhooks in the Symmetry developer portal to update your payroll application based on triggers such as new tax IDs, new tax rates, and jurisdiction changes.

Data automation for modern applications

Payroll tax updates occur frequently throughout the year – taxes are added, edited, or removed and other jurisdictional parameters such as withholding form fields are updated. If the updates are not managed, the client data used to calculate payroll can become stale or exclude newer data inputs necessary to calculate payroll accurately. With Webhooks by Symmetry, you can keep your payroll application up to date with critical payroll updates driven by the Symmetry Tax Engine®.

Register webhooks

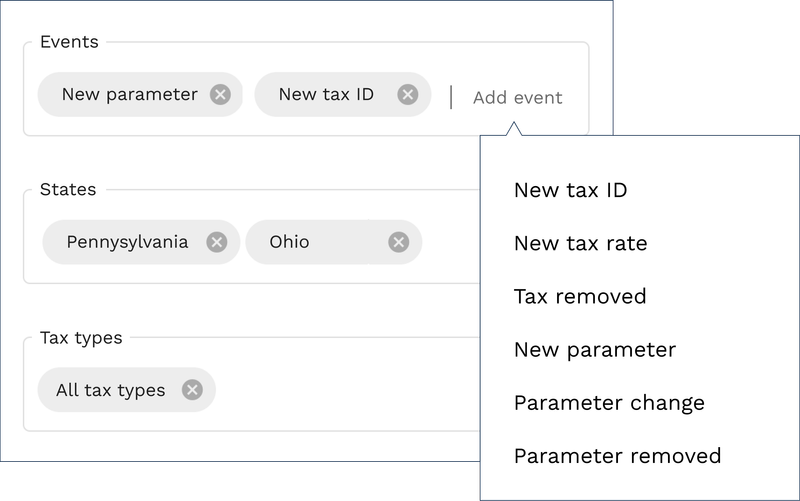

Define your event criteria and be notified programmatically of changes.

View webhook logs

See each payload sent to your server in one view.

Set up email notifications

Receive customized emails reflecting your event criteria changes.

Start syncing with Webhooks by Symmetry

The simple Webhooks by Symmetry interface allows you to register custom webhooks within a developer portal. The webhook will then send data to your application based on specific events within the Symmetry Tax Engine®, including tax rate changes, the addition of new taxes and tax IDs, jurisdiction parameter changes, and more.

Notified programmatically with webhooks

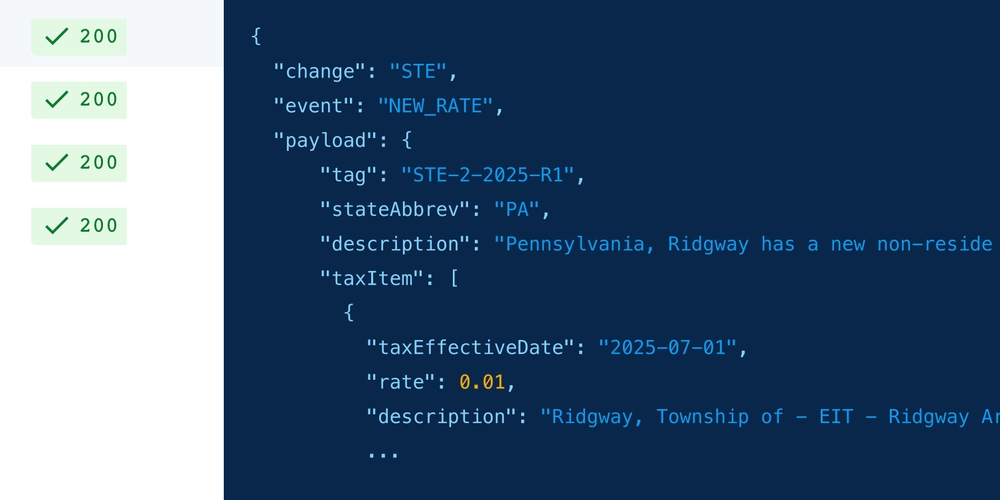

Webhooks by Symmetry sends an HTTP request with a JSON payload to your server endpoint.

Webhook & product update timing

Webhooks by Symmetry notifies you of changes to the Symmetry Tax Engine® as soon as the Web API release is deployed.

Customized notifications

Customize which event types you want to "listen" to and receive triggered notifications by utilizing Webhooks by Symmetry.

Notifications via email

In addition to webhooks, you can register for customized email notifications that are sent when the tax changes that matter to you most occur.

The following tax updates were released in STE-2025-R1a.

| State | Event | Description |

|---|---|---|

| PA | New rate | Description |

| OH | Tax removed | Description |

FAQ

Contact us if you don't find your question answered here about Webhooks by Symmetry.

Get started

Looking for more?

Symmetry Tax Engine

Calculate gross-to-net payroll taxes to build or enhance a payroll product, embed payroll into an existing application, and increase compliance.

Symmetry Payroll Forms

Directly integrates and automates the withholding forms process at the federal, state, and local levels with over 130 compliant forms.

Symmetry Payroll Point

Determines complicated local withholding tax rates within your product by applying latitude and longitude coordinates of a residential address and a work address against Symmetry’s expansive library tax shapefiles, nexus and reciprocity algorithm.