A Deeper Look At Reciprocity Agreements

A deeper look at reciprocity agreements will illustrate just how complicated payroll taxes can be for tax professionals.

Employees living in one state but working in another are sometimes subject to extra payroll withholding taxes, unless a reciprocal agreement between their states exists. Tax reciprocity is an arrangement between two states that lowers the tax burden on an employee. Without this agreement an employee pays the state and local taxes for the work state, but still owe taxes to the state in which he or she lives. With an agreement in place, an employee is exempt from state and local taxes in their state of employment, thus only paying the taxes of the state of which he or she resides. When referring to these type of agreements, two key terms are used: nexus and reciprocity. Nexus is something physical a business has - i.e., its location. Wherever a business owns or leases property is where that business has nexus. Reciprocity - which has loosely been defined already - means the practice of exchanging things with others for a mutual benefit. In this case, that means local and state withholding taxes.

Reciprocal agreements such as these have no effect on federal payroll taxes. No matter where an employee lives or works, he or she cannot escape taxes levied at the federal level - and neither can an employer. Reciprocity agreements apply to any type of wages a person earns through employment, including tips, commissions, and bonuses. These agreements mostly exist on the East Coast and in the Midwest. If an employee works in the District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maryland, Michigan, Minnesota, Montana, New Jersey, North Dakota, Ohio, Pennsylvania, Virginia, West Virginia, or Wisconsin, and is a resident in one of their reciprocal states, he or she can invoke the reciprocal agreement.

An employee must request the taxes of his or her home state be withheld, and not the work state. Employees do this by giving employers a tax exemption form for the work state. Setting up the proper withholding is crucial. Withholding from the incorrect state - especially if an employee has explicitly asked to be exempt for his or her work state - can result in fines. At the end of the year, employers must use Form W-2 to show employees how much was withheld for each state. The New York tri-state area (New Jersey, Connecticut, and New York) do not have any agreements set in places. Employees in these situations will have taxes withheld from their work state and pay taxes to their home state.

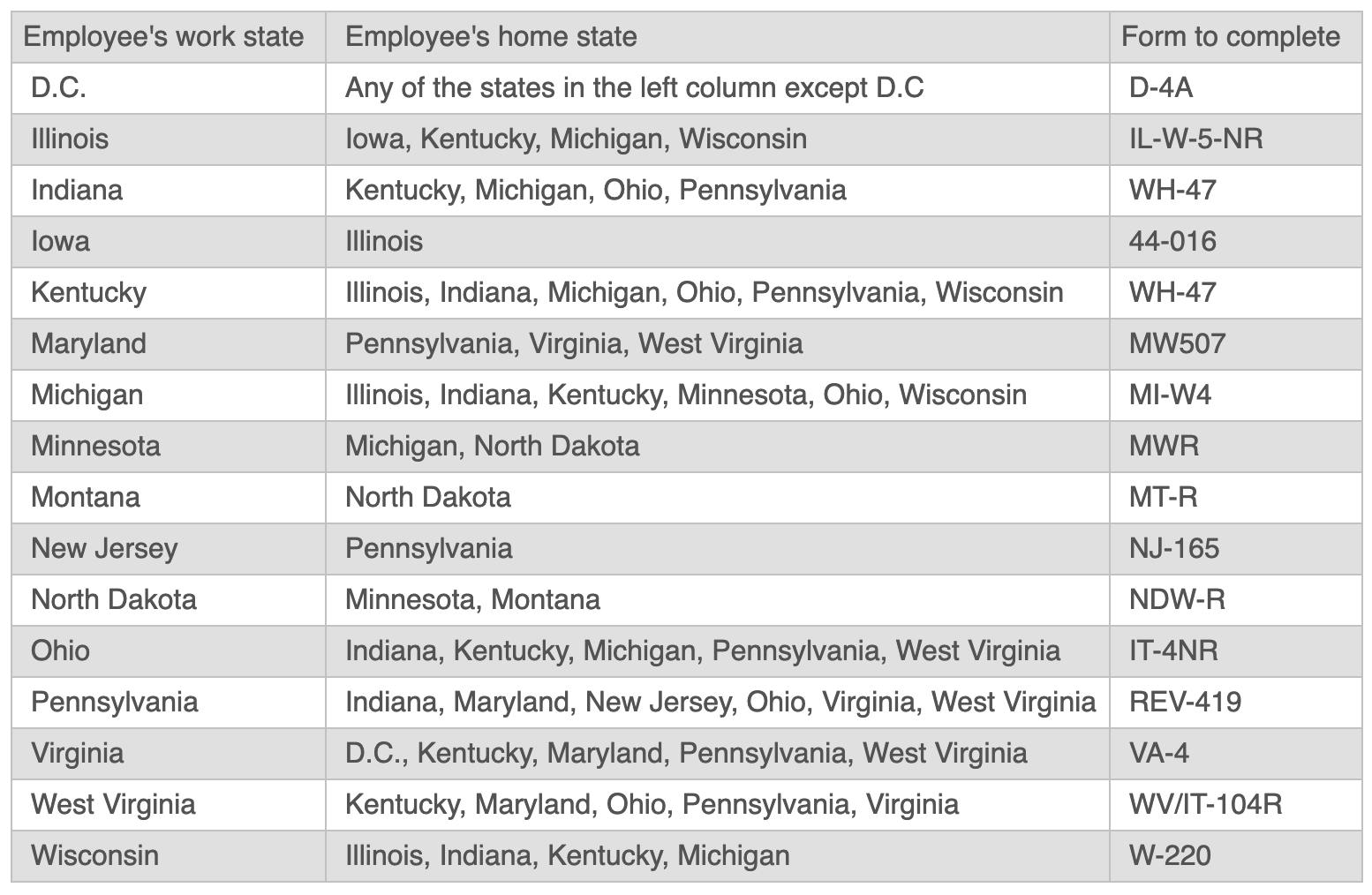

Familiarize yourself with reciprocity agreements below:

| Employee's work state | Employee's home state | Form to complete |

| D.C. | Any of the states in the left column except D.C | D-4A |

| Illinois | Iowa, Kentucky, Michigan, Wisconsin | IL-W-5-NR |

| Kentucky, Michigan, Ohio, Pennsylvania | WH-47 | |

| Iowa | Illinois | 44-016 |

| Kentucky | Illinois, Indiana, Michigan, Ohio, Pennsylvania, Wisconsin | WH-47 |

| Maryland | Pennsylvania, Virginia, West Virginia | MW507 |

| Michigan | Illinois, Indiana, Kentucky, Minnesota, Ohio, Wisconsin | MI-W4 |

| Minnesota | Michigan, North DakotaMWR | |

| Montana | North Dakota | MT-R |

| New Jersey | Pennsylvania | NJ-165 |

| Minnesota, Montana | NDW-R | |

| Ohio | Indiana, Kentucky, Michigan, Pennsylvania, West Virginia | IT-4NR |

| Pennsylvania | Indiana, Maryland, New Jersey, Ohio, Virginia, West VirginiaREV-419 | |

| Virginia | D.C., Kentucky, Maryland, Pennsylvania, West Virginia | VA-4 |

| West Virginia | Kentucky, Maryland, Ohio, Pennsylvania, Virginia | WV/IT-104R|

| Wisconsin | Illinois, Indiana, Kentucky, Michigan | W-220 |