Gig Economy and Taxes: How Payroll Providers Can Navigate Employee Classification and Compliance

With the gig economy on the rise, worker classification is essential now more than ever to payroll providers and their customers—and Symmetry has you covered.

Traditional employment is becoming less traditional. Eighty percent of the largest companies in the US plan to switch to a flexible workforce of freelance and part-time or short-term workers.

This transition isn’t surprising. As of 2021, gig workers already made up 16% of the US workforce, of which 8% were 1099-MISC contract workers, and 8% were short-term W-2 workers.

It feels safe to say that the gig revolution is here to stay. So, if you’re a payroll provider (or building a payroll solution for your people tech platform), it’s essential that you know how to navigate the gig economy and taxes so that you can build compliant products and advise your customers on how to handle the complexity. The importance of compliance can’t be overstated. With the rising population of freelance and short-term gig workers, mistakes such as misclassifications are common—and they can be costly for you and your customers.

In this article, we’ll dive into how you can ensure compliance is built into your payroll product to help your customers avoid employee misclassification penalties.

What is the gig economy?

The term “gig economy” describes a labor market comprising individuals whose professions involve time-based projects, consultations, or part-time positions.

Gig economy workers are known for not receiving an annual salary or benefits. Instead, they’re usually paid on a project, short-term, or hourly basis. Additionally, in many cases, employers of gig workers are not responsible for the gig workers’ state or federal income taxes. We explain gig economy tax considerations in more detail below.

The difference between hiring an employee vs independent contractor

Before building a payroll product to serve the needs of gig workers, it’s essential to understand who actually qualifies as one. The term gig worker typically comprises freelancers, part-time workers, and short-term employees.

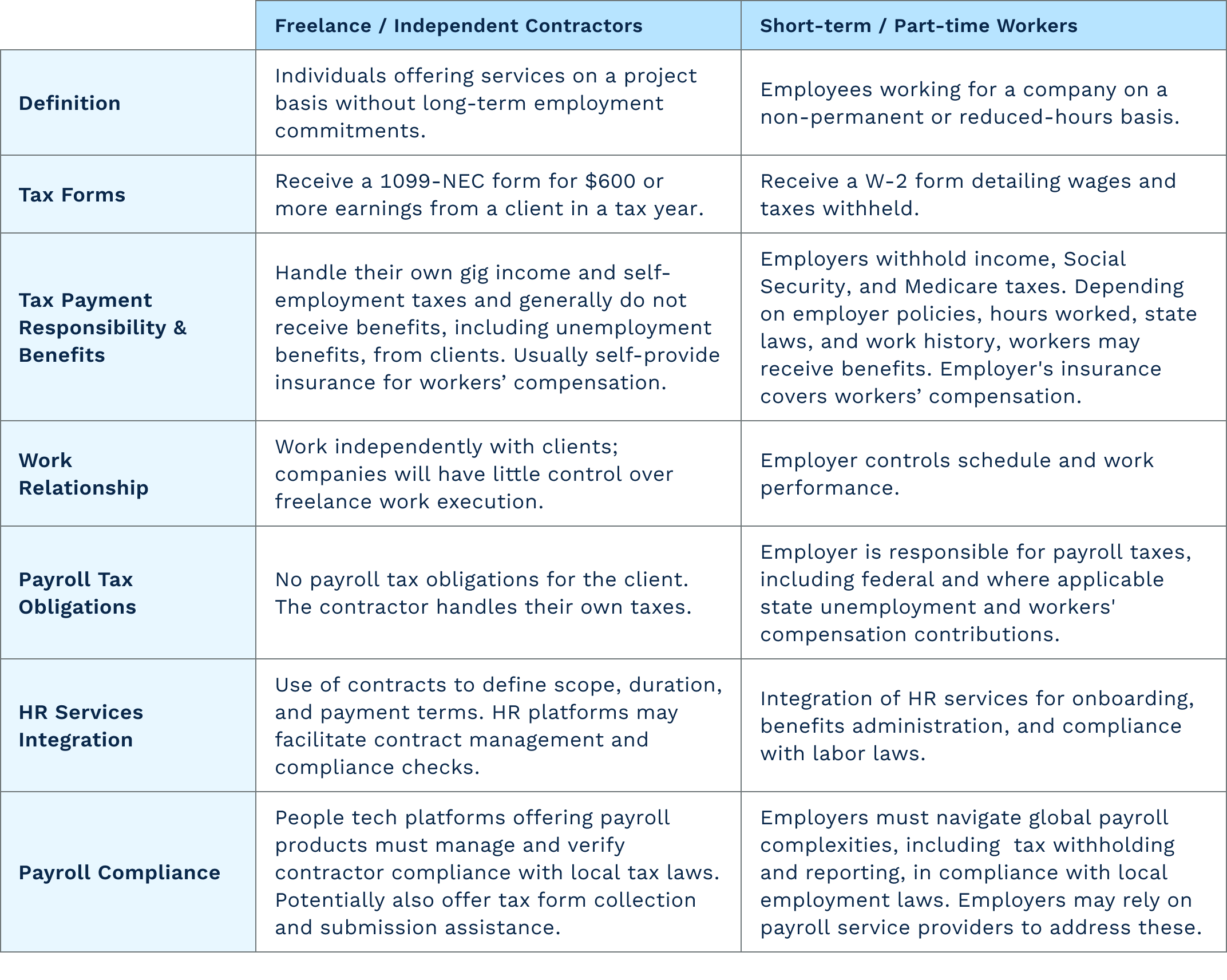

Let’s break down what that looks like, particularly from a tax perspective:

Difference between freelance contractors and short-term and part-time workers

Freelancers, independent contractors, and 1099-MISC

According to ADP’s research into the gig economy, freelance workers or independent contractors are usually highly educated and experienced and paid generously for their specialized skills. They are self-employed individuals, so they’re only required to fulfill contractual obligations they’ve signed up for and often have the power to influence the terms. Many are “free agents,” meaning they’re contractors by choice, not necessity. They usually don’t get benefits other than allowances or reimbursements for out-of-pocket expenses.

Notably, those who work for companies like Uber, Lyft, and DoorDash are classified as independent contractors at present, although this might change in the future. As the gig economy is at the heart of these companies’ business models, they are often under intense scrutiny for accurate worker classification—and rightly so.

On the tax side, employers—including nonprofits, state, and local governments—are required to issue a Form 1099-NEC to any non-employee, inclusive of both freelance workers and independent contractors, who make $600 or more in a given year. Plus, it’s important to note that freelance and independent contractors don’t have any taxes withheld from their payments, meaning they’re responsible for calculating and paying their income taxes, sometimes on a quarterly basis depending on their financial situation.

Part-time workers or short-term workers and W-2s

Part-time and short-term workers, on the other hand, are usually employed by a company, with some caveats around the duration or length of employment (e.g., seasonal or on-call hires). Since they’re technically employees, some of their income is withheld for tax purposes. Depending on the terms of employment, they may or may not get benefits.

Take seasonal workers at an amusement park, for example, who primarily work during the summer. Even though they’re only employed for part of the year, their pay is subject to the same tax withholding rules as full-time employees. From a tax perspective, these workers should be issued W-2s.

The IRS considers any individual whose work can be controlled by employers, specifically what and how it will be accomplished (facts known as behavioral control, financial control, and relationship of parties), as employees, as stated below:

If you have an employer-employee relationship, it makes no difference how it is labeled. The substance of the relationship, not the label, governs the worker’s status. It doesn’t matter whether the individual is employed full time or part time.

There are two ways to determine whether an individual is truly an independent contractor or an employee: the Common Law Test and the Reasonable Basis Test, both used by the IRS. When in doubt, these tests should help you and your customers differentiate between the two from a tax standpoint.

Impact of worker misclassification on you and your customers

Worker classification matters, especially in the realm of gig economy and taxes. If you’re an early-stage startup just finding your feet in the people tech space, the emphasis on accurate categorization, particularly from the tax aspect, may seem excessive. However, it’s an oversight you can’t afford, as it impacts your product, profitability, and credibility.

At least one people tech platform was recently scrutinized by government officials for its hiring practices, specifically for allegedly misclassifying its workers on purpose to evade taxes. Employee misclassification can also mask wage theft, which is both unethical and undermines employers’ and their payroll providers’ reputations. And if your reputation is questionable, it can cost you business.

To ensure your practices and policies remain ethical and in adherence with tax rules, there are two things you need to keep in mind:

Account for mistakes

Typically, employers are on the hook for compliance in tax filings. Penalties can include tax bills to resolve incorrect reporting issues and employee misclassification penalties that come from incorrect tax returns. At first glance, this seems logical, as employers are ultimately the ones accountable to the IRS for accurately categorizing workers and for providing you with the correct information about the nature of work so you can ensure compliance with US tax regulations.

However, the reality is more complicated. Payroll providers can indeed be held liable alongside employers for not fulfilling tax obligations, regardless of whether it’s accidental or intentional. That’s why it’s important for payroll providers to take proactive measures to address potential worker classification and subsequent payroll tax compliance issues. Prevention is key, but mistakes can happen, and it’s how you deal with them when they do that makes all the difference.

Tax regulations change constantly

Keeping up with US tax laws is complicated. In addition to local, state, and federal income tax, you’d have to pay attention to the Federal Insurance Contributions Act (FICA), Federal Unemployment Tax Act (FUTA), and State Unemployment Tax Act (SUTA) for short-term and part-time gig employees who would receive a W-2. And these regulations change all the time and vary from state to state. So, you need to deploy a strong compliance team to monitor evolving laws and you need to build this compliance layer into your payroll product. Then, you have to ensure employees get the right payroll tax forms and that your product makes accurate tax calculations, which isn’t easy, especially at a state level.

There’s increasing pressure for minimum wage compliance

With wage theft on the rise, gig companies are feeling the heat to ensure they pay workers at least the minimum wage. For example, Denver is pushing for the power to issue subpoenas to catch companies that aren't meeting minimum or prevailing wage standards.

Some gig companies are even restricting job posts that don't meet minimum wage thresholds. Plus, a recent Department of Labor ruling is making it harder to classify workers as independent contractors. This push is leading many gig companies to consider adding W-2 gig workers to their platforms. All of these issues highlight the growing need for solid payroll solutions—like Symmetry's Minimum Wage Finder — to navigate the evolving landscape effectively.

Simplify how your people tech platform handles gig economy taxes

All of this can be a lot to tackle, especially as an early-stage payroll provider—unless you have a partnership with an external solution like Symmetry for your product's compliance infrastructure. As you know, compliance is non-negotiable, and the more control you have over your payroll product’s employee classifications and payroll tax calculations, the more peace of mind you’ll have.

That’s where we can help. The Symmetry Tax Engine is the industry gold standard for accurate payroll tax compliance and gross-to-net calculations, and many people tech platforms like yours rely on us to build their product. Thanks to our geocoding technology, we handle the nitty-gritty of payroll tax compliance—from withholding forms to precise multi-state and minimum wage calculations. Plus, with our Payroll Point API, your payroll product can go to market quickly and focus on expanding your product’s core features.

In other words, we handle payroll tax compliance, so you can work on the differentiating product features that set you apart from the competition.

Frequently asked questions

Do gig workers have to pay payroll taxes?

Yes, gig workers have to pay payroll taxes on their income, including federal and state taxes, regardless of whether they're self-employed, part-time, or short-term workers.

Are gig economy workers considered employees or independent contractors for payroll tax purposes?

Gig economy workers are often considered independent contractors for payroll tax purposes, unless their work conditions meet certain criteria that classify them as employees, such as having their work hours, location, and manner of work controlled by the employer.

How do you calculate payroll taxes for a gig worker?

Gig economy payroll tax calculation can be complicated because a lot of it depends on the worker classification. For instance, self-employed contractors are responsible for paying their own income taxes, so payroll providers only need to provide a 1099-NEC to workers who made $600 or more in a given year. But if it’s a short-term or part-time employee whose work conditions are controlled by an employer, taxes should be withheld from the earnings (also known as taxable income), and calculations vary by state, income, and other factors.