How to Navigate Payroll Tax Compliance When Scaling US and Canada

Global payroll compliance is a must for businesses scaling internationally. Learn how to avoid common mistakes, implement effective strategies, and leverage technology to streamline operations and ensure compliance with tax laws and regulations.

Many employers view global expansion as a key driver for growth. After all, new markets come with multiple benefits like fresh opportunities, diverse talent pools, and a wider customer base.

But scaling globally comes with its fair share of challenges, too, including navigating global payroll tax compliance. That’s where you, their payroll provider, come in.

The truth is, if you have customers with global operations, and you don’t have a strong handle on local laws and requirements, a robust process for documenting compliance policies, and adequate resources committed to managing multi-country payroll, your customers will face fines and penalties. This can sow distrust in your product, harm your reputation, and, ultimately, impact your bottom line.

To avoid these outcomes, it’s important that your payroll product can expertly calculate payroll taxes on a global scale. The key to that is working with the right payroll tax infrastructure partner. By relying on their expertise to tackle the heavy lifting (i.e., payroll tax calculations), you can prevent many of the common errors, maintain payroll compliance across various regions, and focus on making your customers happy.

What is global payroll compliance?

Global payroll compliance is the process of aligning an employer’s payroll policies, procedures, and calculations with the specific laws and labor regulations of each location where their employees are based. From a payroll tax perspective, when an employer compensates employees across the world, they have to comply with the unique legal requirements of each applicable tax jurisdiction, including at the country, region, state, county, and town levels.

Accordingly, as stipulated by each tax jurisdiction, your payroll product needs to accurately:

- Calculate wages

- Withhold taxes

- Deduct social security, pension, and health insurance

- Match contributions

Common global payroll tax compliance mistakes

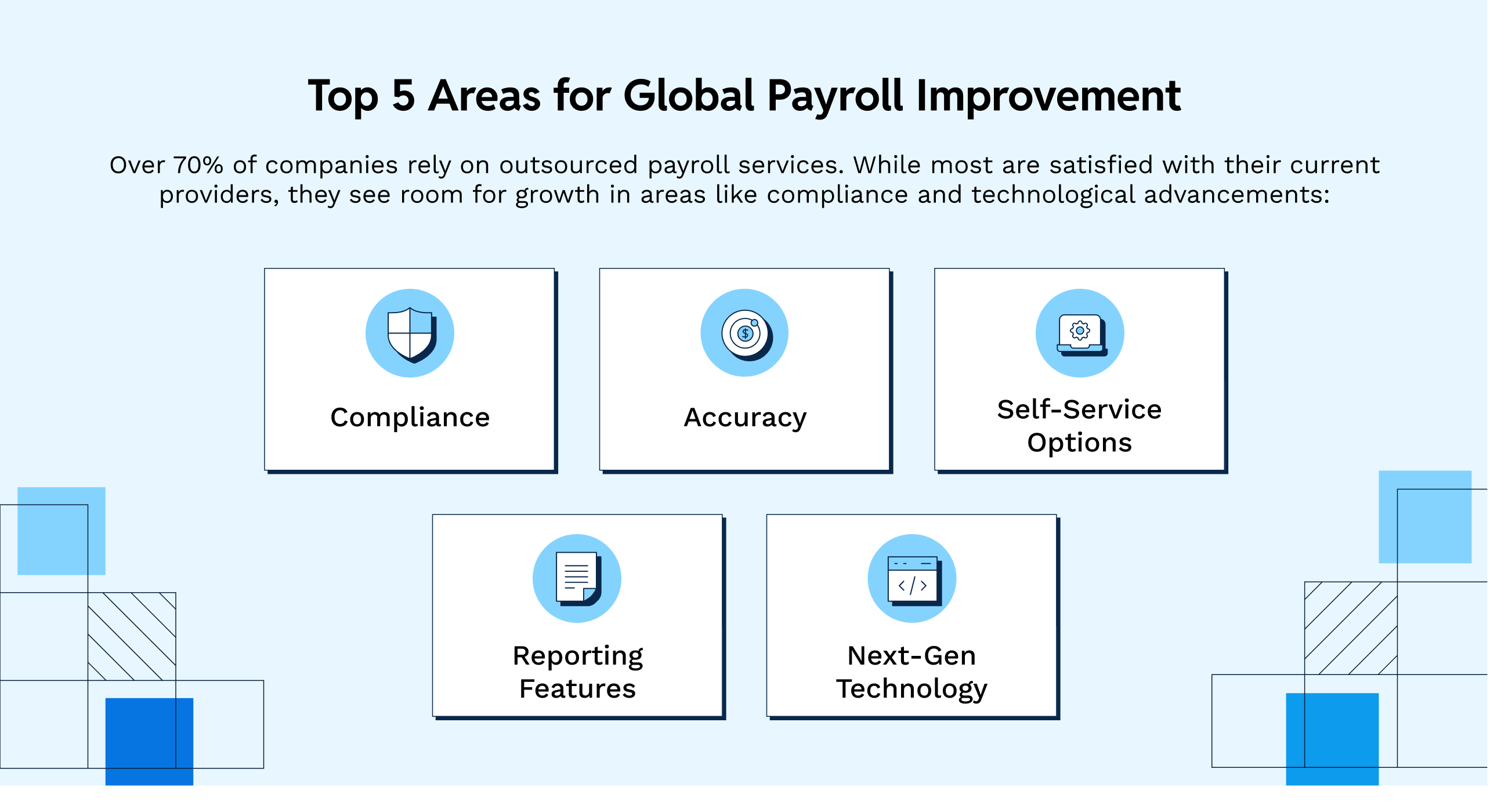

Payroll tax compliance becomes increasingly complex and resource-intensive with a global, distributed workforce. Not surprisingly, Deloitte identified compliance and accuracy among the top five areas needing improvement in the global payroll market.

So, where do most payroll providers fall short when it comes to compliance and accuracy? More importantly, how does it impact your customers? Let’s break down these payroll challenges.

Misclassifying employees

The laws surrounding employee classification vary from country to country and jurisdiction to jurisdiction, making misclassification a common but costly mistake. For instance, if an employer hires freelancers for long-term projects, but treats them as independent contractors without deducting payroll taxes, this misclassification can lead to tax audits and penalties if authorities determine they should have been classified as full-time employees.

And this happens more often than you think. For instance, earlier in 2024, a gig economy customer service company was ordered to pay $3 million for misclassifying workers as independent contractors. As Attorney General Brian L. Schwalb put it, a misclassification scheme is “an illegal practice that is, unfortunately, all too common in the District.” That holds true for the rest of the world as well.

If your customers get caught up in a misclassification lawsuit or audit, even if the misclassification was unintentional, it can reflect poorly on you. So, do your due diligence by getting the right information and documents from your customers to ensure workers are classified properly and have the right employment contracts.

Late or incorrect filings

Missed deadlines and submitting inaccurate information on tax forms are huge compliance risks, resulting in penalties and interest charges. According to the IRS, every year, 33% of employers make payroll errors or don’t meet reporting requirements. If your payroll product is the cause of one of these errors, it might damage your company’s reputation and make your customers vulnerable to further audits and investigations.

Poor Record-Keeping

Another common mistake employers make is inadequate documentation of international payroll. Without accurate records of each employee's payments, payment dates, and details like social security contributions and tax withholdings, they can’t demonstrate compliance during audits. As their payroll provider, it’s on you to gather all the necessary documents for clear and transparent record-keeping on employers’ behalf.

Inadequate Protection of Employee Data

Failure to protect employee data also leads to non-compliance. As a payroll provider, you’ll handle sensitive information like home addresses and bank details, which need secure storage and management to protect data privacy.

For instance, regulations such as the GDPR in the European Union set strict rules on handling employee data. Even if an employer operates outside of Europe, they may need to follow these rules if they handle data from EU residents. Failing to safeguard personal data can lead to legal issues and privacy breaches. So, you’ll want to ensure your payroll product’s security is up to date and that you fiercely protect employee data.

4 steps to navigate global payroll tax compliance

While the challenges are many, you can take active steps to stay compliant with international payroll tax laws and regulations.

1. Research and understand local tax laws

The first step in managing global payroll tax compliance is thorough research. Understand the local tax and employment laws in each country where your customers operate, especially if you’re offering employer of record (EOR) services in different countries. This includes income tax rates, social security contributions, and any additional payroll-related taxes. For instance, in Germany, employers must deduct wage tax and contributions to social security from employees' income.

Compounding the challenge is the fact that these laws change often, and keeping up with those changes is a full-time job that requires a dedicated team. But having a research team dedicated to compliance, especially on a global scale, is resource-intensive and expensive. So, you may want to rely on third-party payroll tax experts to help you stay compliant.

For example, if you have or are building a US or Canadian payroll product, you can leverage Symmetry’s compliance infrastructure. Our tax research team stays up to date on all the latest national, state and provincial, and local regulations, and we update our software accordingly—so you don’t have to worry about the accuracy of your payroll calculations or compliance.

2. Automate compliance monitoring

Automation can significantly reduce the risk of human error and ensure timely compliance with payroll tax regulations. When payroll providers obtain automatic updates on tax law changes and compliance deadlines, generating necessary reports and filings becomes a breeze, allowing them to manage compliance for employers across different locations.

Take Topsheet, a provider of film and television production payroll solutions, as an example. They faced challenges with manual payroll calculations because of frequent tax rate changes across jurisdictions. By integrating with Symmetry Tax Engine, Topsheet automated tax calculations across all U.S. states and territories, ensuring accurate payroll processing and compliance with the entertainment industry’s complex payroll regulations.

Thanks to automation, Topsheet improved operational efficiency and client satisfaction with precise and prompt payroll results.

3. Keep detailed records

Maintaining detailed and accurate records of all payroll transactions is crucial for compliance. And remote work with globally distributed teams only makes this harder. In case of an audit, having well-organized payroll records can demonstrate compliance efforts and help your customers avoid potential fines.

4. Train your team

Your team plays a crucial role in keeping your customers payroll tax compliant. So, provide regular training on payroll tax best practices and compliance requirements to help your team and by extension, your customers stay updated on the latest tax laws and improve their ability to manage global payroll services efficiently.

In the end, continuously upskilling and reskilling means growth for them and sound compliance practices for you.

Lean on technology to manage payroll compliance

Providing payroll services for your customers’ global workforce is an exciting growth opportunity for your company. But if you’re entering that arena, you have to plan carefully and use the right resources to navigate the complexities of payroll tax compliance and set your payroll product up for success.

One such strategy is leveraging the right technology. Whether you’re handling withholding forms, facing complex tax withholding scenarios, or trying to identify new minimum wage rules, a partner like Symmetry can make life—and payroll calculations—easier for you and your customers.